How to manage your debt during inflation

Inflation has really taken hold of us Danes and regardless of income, most people have realized that interest rates have risen and the prices of energy and groceries have exploded.

Are you among the many Danes who have debts to companies, the public sector or debt collection agencies? If so, inflation has probably hit you even harder, and paying off your debts may feel unmanageable or even impossible.

As a debt collection company, we have more than 150 years of experience in advising on debt, and in this post we will focus on what we believe you should pay special attention to when you have debt during inflation.

This post is both for those who are able to settle their debts (regardless of the type) and for those who are unable to settle their debts.

What is the theory of debt under inflation

There are many theoretical approaches to managing debt during inflation. If you have the possibility to pay off your debts, such as bank loans, unpaid invoices, debts to the government or other debts, start with the debt with the highest cost (APR).

For the most part, debts of any kind and type will often come at a price. A price in the form of interest, fees, commission, collection costs or similar.

Especially during inflation, when common goods and services are rising, it is preferable to reduce your fixed costs. If you are able to reduce your fixed costs, you will often be in a stronger position during inflation. Therefore, your expenses that are causing your debt would be a good place to look. In a classic inflationary environment, securities, stocks and bonds will not provide a very favorable return, so paying down debt may be the best investment during inflation. So if you have bank debt or debt to private or public creditors, and the ability to pay off just a little of your debt, this could be a good idea.

Are you unable to pay off your debts below the inflation rate?

If you are among the many Danes who have been hit hard by rising prices, debt settlement will typically not be possible.

Our clear recommendation to you is to be especially forthcoming and honest about your financial situation with your creditors, whether private or corporate. If you are not able to pay your debts now, be honest about it, as most people would understand your situation.

Debt is often associated with a cost, such as interest, fees or similar. Especially during inflation, companies, debt collection agencies and individuals will pay particular attention to recovering their outstanding debts. However, if you are unable to settle your debts now or in the near future, we recommend that you make your creditors aware of this - even if it is difficult and hard work to do. Few people find it easy to talk to debt collection companies and other creditors about their non-payment or settlement, but silence on the part of the debtor is often not the best option.

What are your options if you cannot settle your debts?

If you choose to engage in a dialog with your creditors or debt collection companies about your debts and your financial situation, they will often be both understanding and accommodating, because it is in your interest and theirs.

This will often result in you finding a solution together, such as an installment plan, a partial payment now or full repayment within a shorter or longer period.

How to get started on settling your debts

How do you actually start paying off your debt during inflation?

Whether you have the opportunity to settle your debt or not, it is our clear recommendation that you get clarity and overview of your debt and the companies and debt collection companies to which you owe money. In addition to a good overview and clarity of your debt, it is almost impossible to settle it.

If you do not have the energy or the means to get an overview of your debts yourself, you may be able to seek help from friends or family members.

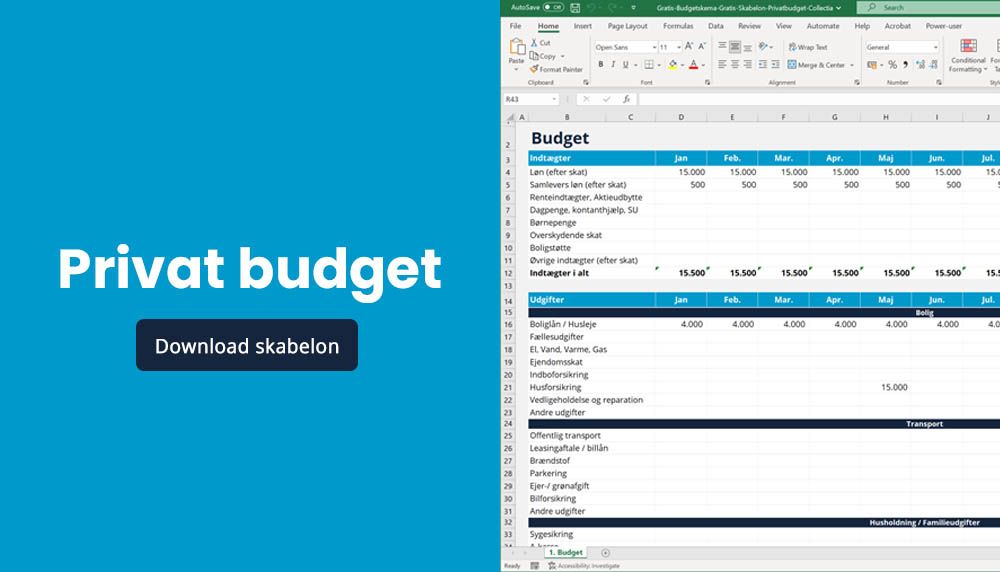

Once you have a clear idea of your debts, you should draw up a budget with all your expenses to keep track of your incoming and outgoing payments so you know what you are spending your money on.

Such a budget can also be used in negotiations with your creditors.

We hope that this post has given you clarity and inspiration about debt repayment during high inflation. Although it is not easy, we hope that we have been able to contribute with some new knowledge and motivation to make good progress with your debt settlement, regardless of when you have the opportunity to do so.