Collection fees - What fees can I charge my customer?

Every year, thousands of invoices are sent from Danish companies and fortunately, the vast majority of them find that their invoices are paid on time and that no debt collection or further action is required to collect the outstanding amount.

Unfortunately, many self-employed people also experience from time to time that one or more of their annual claims are not paid. The reasons are many, and can be due to anything from a simple oversight on the part of the customer - to deliberate non-payment for one reason or another. For most traders, the natural solution is often debt collection, either in the form of self-collection, a debt collection agency or a lawyer. But what fees are you actually allowed to charge in so-called debt collection fees and when can they be charged? In this article, we take a closer look at which debt collection fees you as a creditor can impose on a debtor and when they can be charged.

What are debt collection fees?

Most people consider debt collection fees to be the total fees, reminder letters, interest and collection fees that may be charged - but in this article, we only look at the fees that the Danish Interest Act prescribes as "fees" or "collection costs". In this article, we therefore disregard reminder fees, interest and compensation fees - which have no influence on your collection fees.

Collection fees, or debt collection fees, are fees that you as a creditor (or your lawyer/collection agency) can and often will charge if your debtor fails to pay on time. The fees are intended to help cover the costs you as a creditor (or your debt collection agency/lawyer) incur in collecting the amount owed.

There are two general types of debt collection fees - those you can charge yourself (self-collection) and those your lawyer/collection agency can charge (third-party collection)

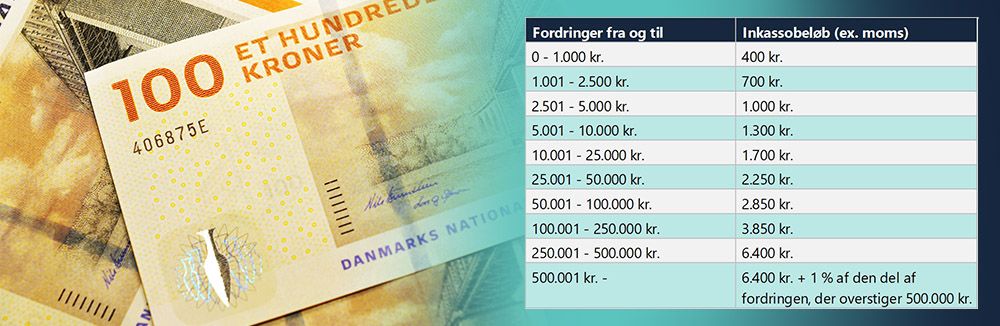

The fees are tiered - and increase in categories depending on the size of the claim.

For third-party debt collection, the tariffs are as follows:

| Receivables from and to | Amount to be collected (ex VAT) |

| 0 - 1.000 kr. | 400 kr. |

| 1.001 - 2.500 kr. | 700 kr. |

| 2.501 - 5.000 kr. | 1.000 kr. |

| 5.001 - 10.000 kr. | 1.300 kr. |

| 10.001 - 25.000 kr. | 1.700 kr. |

| 25.001 - 50.000 kr. | 2.250 kr. |

| 50.001 - 100.000 kr. | 2.850 kr. |

| 100.001 - 250.000 kr. | 3.850 kr. |

| 250.001 - 500.000 kr. | 6.400 kr. |

| 500.001 kr. – | DKK 6,400 + 1% of the part of the claim exceeding DKK 500,000 |

And the fees for self-collection:

| Receivables from to | Amount to be collected (incl. VAT) |

| 0 - 1.000 kr. | 300 kr. |

| 1.001 - 2.500 kr. | 500 kr. |

| 2.501 - 5.000 kr. | 650 kr. |

| 5.001 - 10.000 kr. | 850 kr. |

| 10.001 - 25.000 kr. | 1.150 kr. |

| 25.001 - 50.000 kr. | 1.400 kr. |

| 50.001 - 100.000 kr. | 1.850 kr. |

| 100.001 - 250.000 kr. | 2.550 kr. |

| 250.001 - 500.000 kr. | 4.250 kr. |

| 500.001 kr. – | DKK 4,250 + 0.67% of the part of the claim exceeding DKK 500,000 |

What you should know about debt collection fees

Basically, as a creditor, you should know that all interest, fees and collection charges you can and may impose on a debtor are regulated by the Interest Act and the Debt Collection Act. In other words, you cannot impose arbitrary collection fees on your customer - and collection fees vary depending on the size of your principal - the higher the claim, the more you can impose. The amount of the fees can be seen above - and are different depending on whether you as a creditor impose the collection fee or whether it is your lawyer or collection agency that makes the assignment.

You may only impose debt collection fees when your debtor has defaulted on a claim - for example, by exceeding the payment deadline- and you have previously sent a debt collection notice that meets the requirements for such a notice.

You can basically decide when the collection fees are imposed in the collection process - however, it is important that your debtor has been notified in a debt collection notice / demand letter at least 10 days before the actual collection process, and thus the process for when the collection fees are imposed. In the actual collection process, you decide when the fees are imposed, however, most companies and debt collection agencies choose to do it relatively quickly, as often 1 - 3 reminder letters and a compensation fee are sent in advance.

Are there any other fees, interest and compensation I can get from a debtor?

Yes, you can! In addition to the statutory debt collection fees, you as a creditor also have the option of charging a reminder fee of DKK 3 x 100, interest and a compensation fee if your debtor is a business.

All fees, interest and compensation charges that you as a creditor can impose on a debtor should be seen as covering the actual additional costs you incur for the work involved in evicting a debtor.