Reminder process

A reminder process is a term for the process a customer is in when an invoice (or other monetary claim) has not been paid and the company has now decided to send reminders.

There is no legal or formal definition of what a reminder process should look like - it is often very different from company to company.

What makes a good reminder process?

As mentioned, there is no right or wrong form of reminder process, it basically depends on where you as a creditor want to wait for an unpaid invoice to be paid before any debt collection or other legal action. We often see that many companies choose to send 1, 2 or even 3 reminder letters - with or without reminder fees - before the debt collection notice is sent.

In addition, many companies also use calls as an active part of their dunning process. Similarly, many companies also use the compensation fee as part of their dunning process if they have an outstanding debt with a business customer.

Want to send reminders to your customer yourself?

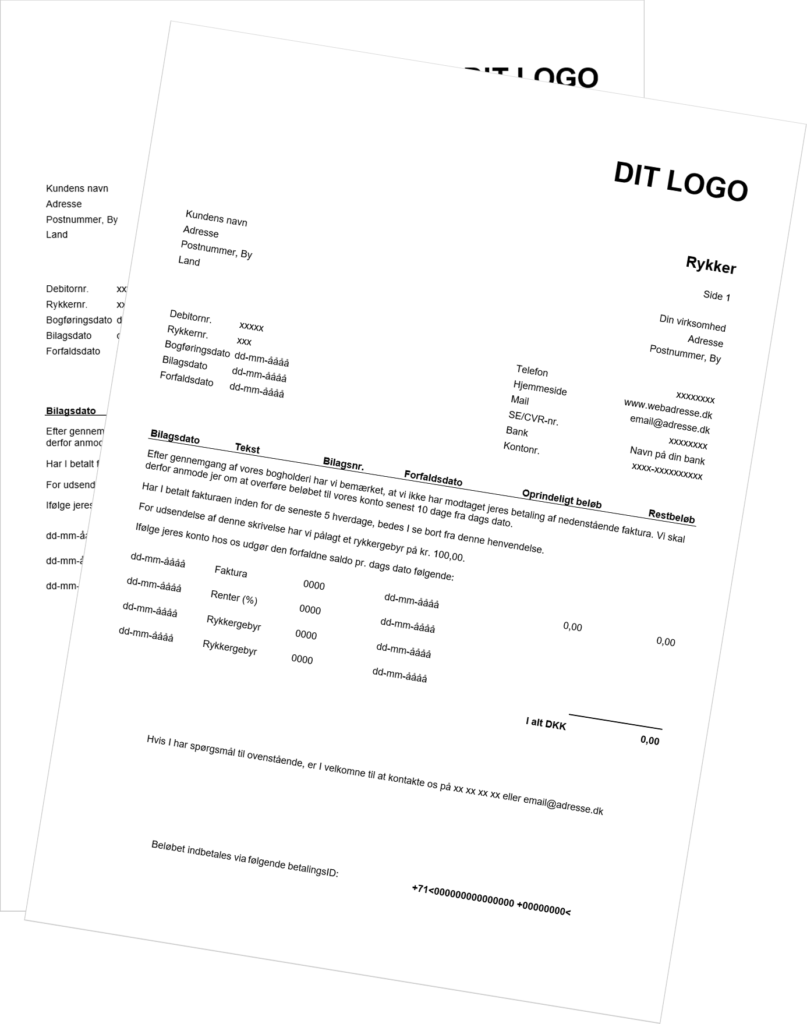

In most cases, it makes the most sense to let third parties send reminders to your debtors. If your reminder is sent from a debt collection company, they will increase the chance of payment. However, some businesses choose to manage the process. That's why we have developed a reminder template that you can use in your reminder process. Naturally, it complies with Danish legislation.

What does the law say about the reminder process?

The law basically does not say anything about what a reminder process may and must contain. It is basically up to the company itself to put together their reminder policy in the most efficient way possible.

If you want to impose reminder fees, there are a large number of requirements that you must comply with. Among other things, there are requirements and rules for how much you can impose a reminder fee, when the fee may be imposed, and how long there must be between each imposition.

If the company uses compensation fees for business customers in the dunning process, there are also requirements and rules for this.

The specific requirements and rules

If you impose a reminder fee on your reminder letters, the maximum fee is DKK 100 per reminder letter. In addition, as a creditor, you must give the debtor a minimum of 10 days to pay the claim(principal + imposed fees).

No reminder for payment can be sent before the 10 days have elapsed.

If the debtor has still not paid the claim after the 10-day payment deadline, you must then send another reminder with a reminder fee of DKK 100. Here the 10-day payment deadline applies again.

If your debtor is a trader (B2B), you may also impose a compensation fee of DKK 310. The compensation fee is independent of your other reminder fees. A payment deadline of 10 days must also be given. You can impose a maximum of one compensation fee per claim.

Example of a reminder process

A reminder process can be structured in many different ways, here is an example of a reminder process that you can use as a starting point and inspiration.

- Due date

- Day 5: First reminder sent, subject to a reminder fee of 100 kroner

- Day 15: Second reminder sent, subject to a reminder fee of 100 kroner

- Day 25: Third reminder sent, subject to a reminder fee of 100 kroner

- Day 35: Collection notice, imposed compensation fee (B2B only) of €310