Reminder fee

A reminder fee is a fee that you, as a creditor, can impose on a reminder letter when an invoice has not been paid. In this article, you can read about everything you need to know about reminder fees and, in particular, reminder letters where the fee is charged.

What is a reminder fee?

A reminder fee is a fee that you as a creditor may impose on your reminders to your debtor. The reminder fee can be seen as compensation for the non-payment and any associated costs that you as a creditor incur by having to reminder for payment. It is important to note that the reminder fee is not directly equivalent to any loss due to non-payment, but can only be seen as compensation - not to be confused with the compensation fee.

Reminder fee rules?

The rules for reminder fees can be found in the Interest Act.

As a private company, you may, according to the Danish Interest Act §9b, impose a maximum of DKK 100 in reminder fees per reminder letter. In addition, you may send a maximum of 3 reminders per case where you have included a reminder fee.

If your debtor is another private company, you can derogate from section 9b of the Interest Act and charge a higher fee through standard commercial agreements, where both companies have concluded a specific agreement with different terms for reminders and reminder fees.

If, on the other hand, your customer is a private debtor, the reminder fee you impose must not exceed DKK 100 per reminder letter. The DKK 100 fee is inclusive of VAT according to SKAT.

If your company does not comply with the law on reminder fees; deadlines and the amount of the fees - your customer is not obliged to pay your imposed reminder fees.

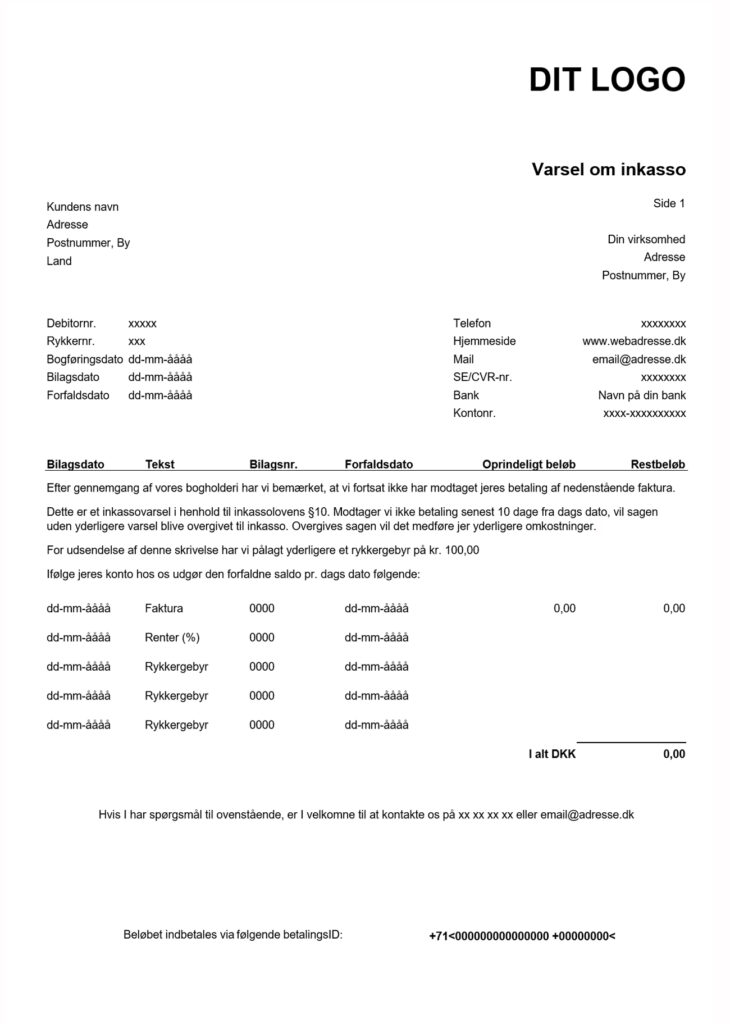

Example of a reminder - free to download

Are you one of the few businesses that want to handle invoice follow-up yourself? Specifically, sending reminders? Then you're in luck. We have created a reminder template that you can download.

How often can I send reminders?

In principle, you can send all the reminders you want, but if you want to impose a reminder fee on your reminders, there are certain requirements you need to follow.

For a reminder with a reminder fee to be valid, it is a requirement that the debtor is given a payment deadline of at least 10 days to pay the claim plus reminder fee. This means that you can, for example, send 3 reminders including reminder fees over a period of 30 days and impose 3 x DKK 100 reminder fees.

There is no requirement that you as a creditor cannot give the debtor a payment deadline longer than 10 days to pay your reminder fee. It just can't be shorter than 10 days. We recommend that you do not give a payment deadline longer than 10 days to minimize the time in the reminder process as much as possible.

Late fees are only an option - not a requirement

Unfortunately, many people believe that reminder fees must be charged when sending out reminder letters, but this is not correct. The imposition of a reminder fee is only an option that the Danish Interest Act gives you as a creditor. You are therefore not obliged to impose a reminder fee. If you do not impose any additional costs on your reminders, it is often referred to as a "friendly reminder" - but it serves the same purpose as a reminder with a fee.

Whether or not you want to add reminder fees to your sent reminders is entirely up to you as a company. To utilize the opportunity that the Danish Interest Act gives you as a creditor, the following requirements must be met:

- Maximum of 3 reminder letters with reminder fees imposed

- Maximum reminder fee of DKK 100 per reminder letter

- Minimum 10 days between reminders including reminder fee

The debtor has an objection

If you receive an objection from the debtor in response to your reminder letters, this objection must be processed before the reminder process can continue. The objection itself does not mean that the debtor can waive the claim and the dunning process, but as a creditor, it is necessary to process the objection before the dunning process can continue.

For example, if you as a creditor have sent the first reminder and the debtor has objected, this objection must be answered before you can send the second reminder.

In some cases, the debtor will maintain their objection even though you have dealt with the objection in the first place. This means that the reminder process should be terminated and treated as a civil lawsuit instead.

What is Collectia's recommendation?

Our clear recommendation is that you as a company establish a clear policy for your dunning procedure. This means that you should decide in advance which reminders you will send, when you will send them and what fees you will charge. It is important to be consistent and adhere to your internal reminder procedure.

As a company, you should establish the following:

- How soon after the due date is the first reminder sent?

- How many reminders are sent?

- Which reminders are subject to reminder fees?

- How often are outstanding balances posted and checked?

- Should all customers have the same reminder procedure?

We can help ensure consistent and uniform dunning procedures, which can ultimately help companies improve their liquidity and cash flow.

Reminder fee and compensation fee

Back in 2013, Danish and European companies were given the opportunity to impose an additional fee in the dunning process - the so-called compensation fee.

The compensation fee is a fee of 310 kroner that may be imposed on all business customers who have not paid their invoice on time.

The compensation fee may be imposed once - and may be imposed on a reminder letter where a reminder fee is also imposed.