6 tips to improve your personal finances

Collectia is a modern debt collection company that uses leading technologies, lawyers and experienced debt counselors to help Danish companies recover their unpaid invoices.

Collectia has some of Denmark's most skilled debt advisors who help Danish private individuals and companies out of their financial situation on a daily basis.

At Collectia, as a debt collection company, we have a great social responsibility to make our knowledge and technology available to help as many people as possible with their financial challenges - for the benefit of Danish companies and individuals.

Based on our more than 150 years of experience as a professional debt collection company, here are our 6 best tips on how you as a private individual can get a better personal finances. 6 tips that will undoubtedly benefit your finances.

1. Get an overview

The key to a good financial situation is to have an overview of it. No matter what your financial situation is, it is necessary to have an overview of your income and expenses, otherwise you won't know what you are navigating from.

Unfortunately, many people have little or no overview of their finances - and often it is the expenditure side that is not completely clear.

Our recommendation is to get an overview of your monthly finances. Start with a simple Excel sheet or a piece of paper - write down your income minus your expenses. It may sound simple, but start like that.

Your online banking can often provide a good insight into your spending if you use your debit card to pay for most things.

However, if you have a lot of cash payments, accounting for expenses can be a challenge.

Start by writing down all your fixed expenses. Note that some expenses may be deducted annually, semi-annually, quarterly and monthly. Then you will know what your disposable income is each month.

2. Make a budget - and stick to it

Once you have an overview of your income and expenditure, you are ready to draw up a budget.

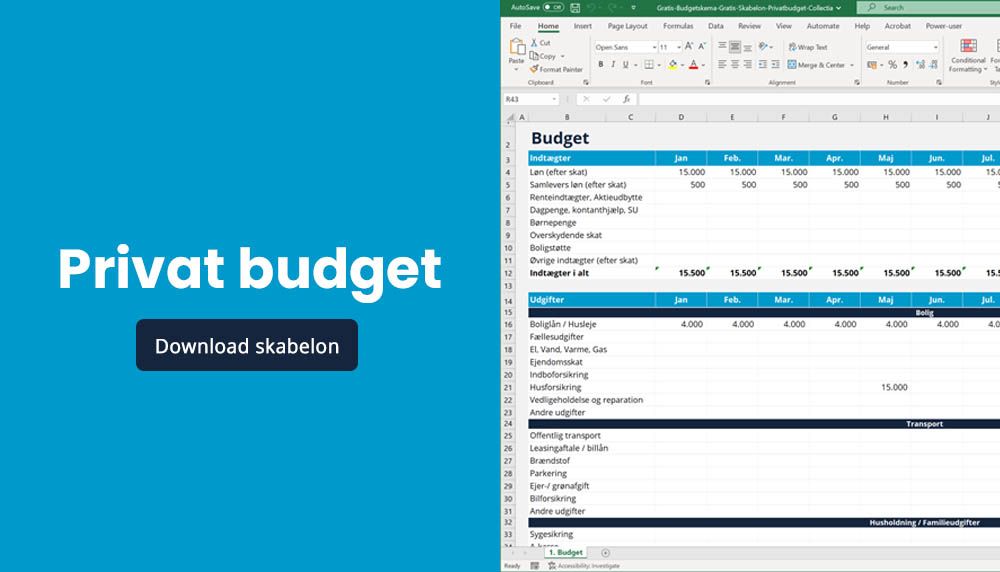

We recommend that you create a budget in Excel, for example, or in Google's free spreadsheet program Google Sheets. This is by far the most flexible way to do it. It allows you to continuously adjust and add your expenses. If you use Google Sheets, you can easily access your budget on your smartphone by downloading the Google Sheets app.

The budget can give you an overview of your income and your fixed expenses (rent, telephone, light, water and heating). This way you know how much money you have for food, clothes, entertainment and miscellaneous items. The amount of money you have available after your fixed expenses are paid is often called your disposable income.

Once you've made this list and know what your disposable income is, you can then allocate how much money you have for food, clothes and entertainment, for example. Make sure you set a realistic amount - and stick to it, otherwise things can quickly go wrong.

Free budget form - Personal budget template

3. Cut out unnecessary spending

As mentioned above, your disposable income is your income minus your fixed expenses. This amount can of course vary greatly from one household to another.

However, many people can have a big impact on their disposable income. Often it is not additional income that needs to be changed, but often one's expenses that can be looked at.

In many cases, you will find that you have a lot of smaller payments spread over a month that add up to a large amount. For example, if you have a basic TV package and 2-3 streaming services, the cost of this might look like this:

- Yusee TV package: 299 kr./month

- Netflix Premium: 149 kr/month.

- Viaplay Movies & Series: 119 kr./month

- TV2 Play Favorit without ads DKK 149/month.

In isolation, neither DKK 149 nor DKK 299 per month is a lot of money for most people and therefore often not something we think much about. But the above example is a total monthly expense of DKK 716 - that is, over DKK 8,592 per year, just for TV and streaming services.

Cutting out unnecessary expenses (subscriptions, streaming services, etc.) can often save thousands of euros every month.

You may also want to check your insurance policies and get quotes to see if you can get a cheaper solution that covers your needs. You can also check with your phone provider to see how much data and talk time you really need. You may be able to reduce your subscription to one that is cheaper but still suits your usage.

4. The food post is expensive

It is no secret that inflation is on the rise, with energy and food in particular continuing to keep inflation high. According to Statistics Denmark, Danish food prices are among the most expensive in the EU, with bread, cereals and fish in particular being much more expensive compared to other EU countries.

Rising food prices are putting pressure on Danish households. According to the Ministry of Food, an average Danish family with children spends about DKK 500 more per month on food.

Our recommendation, as with all other budget items, is to set aside your desired monthly spend in your budget and stick to it.

All studies also show that you can save a lot of money by, for example, buying in bulk - i.e. a few times a week. This avoids impulse buying and avoids buying things you don't really need.

Another way to avoid the burden of rising food prices is to follow official dietary guidelines and reduce food waste. Make a meal plan and use the ingredients you have. If you have leftovers from dinner, eat them for lunch or dinner the next day, or freeze them for another day.

5. Contact debt collection agencies and/or debt collection lawyers - if you have been sent to debt collection

If you have a large number of unpaid invoices, debts and loans that have gone to a debt collection agency, debt collection lawyer or bank - it is a good idea to contact them.

Most of them are aware that you may have difficulties paying your outstanding debt right now. Therefore, they are often willing to make agreements, reductions in the amount, interest freezes, installment plans or similar.

We therefore recommend that once you have an overview of your finances, you contact your creditors - it is often far cheaper than doing nothing. Most claims and unpaid invoices that are with a debt collection company, for example, are often attributed with over 8% annual interest - or DKK 8000 for every DKK 100,000 you owe. It adds up if, in other words, you don't get a settlement plan and do nothing at all.

6. Create a budget account

The vast majority of people have a budget account, but unfortunately many don't - and that can be dangerous!

In other words, once you have an overview of your financial situation and have drawn up a budget, you will know exactly what your monthly expenses will be for your essential fixed costs: rent, electricity, water, heating, etc.

From this amount, you should transfer a fixed monthly amount to an account from which your expenses are deducted. This account should NOT be used for unforeseen expenses. This will ensure that all your fixed expenses are paid each month. Such an account is called a budget account.

If you don't already have a budget account, talk to your bank about setting one up. They can often also help you register your payments with PBS/NETS so you don't have to do it yourself.