How to review your expenses and find savings

At Collectia, we help individuals every day with their financial situation and provide ongoing advice and guidance on personal finance.

At Collectia.dk you can find tips and tricks to improve your finances and perhaps reduce your debt to your creditors.

In this section, we focus on expenses and how you as an individual can review your expenses - and maybe even save money.

Why should I review my expenses?

As a private individual, you should regularly review both your fixed and variable expenses to make sure you're not paying too much or too little.

Many individuals typically have high overhead costs for fixed expenses. A regular review not only ensures that you're getting the right prices, but also that you're not paying for things you don't need.

With an ongoing review of your expenses, you can also ensure that you are always correctly covered by your insurance policies and the like.

What expenses can I reduce?

Basically, you can reduce all your expenses, but some can be harder to reduce than others. Certain expenses, such as food, gas, light, water and heating, can be hard to cut unless you radically change your consumption.

However, that doesn't mean you can't think about shopping cheaper and smarter than you do today, whether it's for food, fuel or electricity.

In particular, it makes sense to regularly review your fixed expenses such as insurance and subscriptions.

Some expenses may also be easier to reduce or cancel than others. This applies to digital services and insurance, for example. Meanwhile, expenses and terms and conditions, such as those related to your bank, can take longer to negotiate with your advisor. Switching banks can often be a longer process, making it more difficult to switch banks.

How to review your fixed expenses on an ongoing basis

If you have a budget, you'll also have an overview of what you're paying for on a regular basis.

Use the line items in your budget to assess which expenses you need to review. Once you've identified which expenses should be reviewed, work from the following principles:

- Check if there is a cheaper alternative.

- Assess whether your current solution is too comprehensive for your needs.

- Consider whether you use the solution at all and whether it can therefore be cut out completely.

- Decide if the solution is more 'nice-to-have' than 'need-to-have' and can therefore be dropped.

Going through the above will take some work, but typically there will be money to be saved every single month.

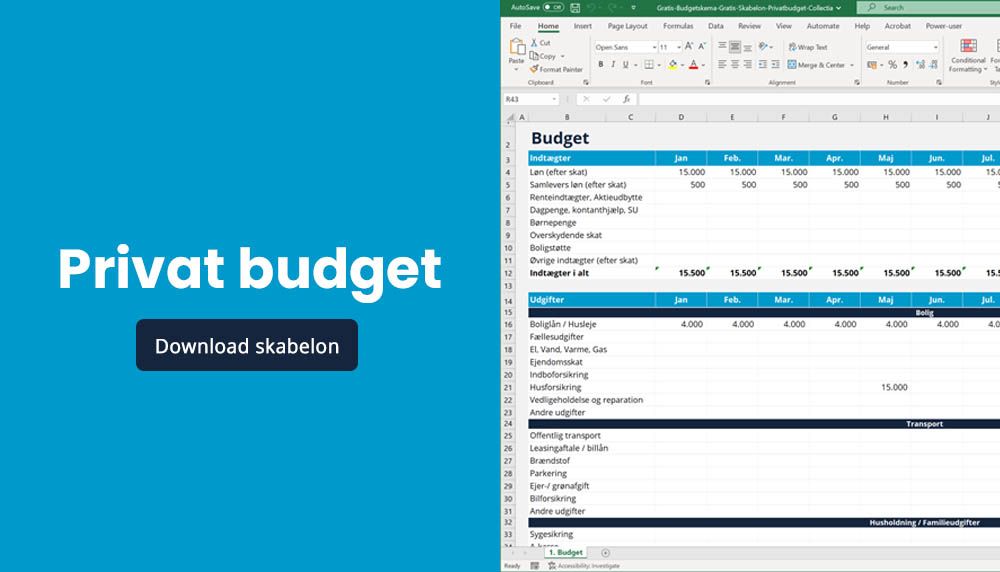

If you don't have a budget, it can be difficult to get an overview of your expenses - and what you can cut back on. That's why we always recommend that you create a budget. Download our budget template here:

Cut unnecessary subscriptions and expenses

It's not always a good idea to simply reduce your expenses - sometimes it can be a good idea to eliminate them altogether, especially if they are no longer in use.

Ask yourself: Are you using all your streaming subscriptions? Is the big TV package still necessary after the kids have left home? And which insurances are still essential for you?

Many can often eliminate entire expenses with a few clicks on a computer, tablet or mobile phone.

Be careful not to save in the wrong places, like insurance and unemployment insurance

While it can be tempting to save on things like insurance and unemployment insurance, we recommend that you pay special attention to what you remove.

Insurance can be expensive, but it's often far more expensive to be uninsured or underinsured in the event of an accident. One option could be to review your insurance policies regularly and get quotes from other insurance companies that can match coverage and terms at a lower price.

The same goes for unemployment insurance funds and similar work insurance. Although it may seem tempting to save on unemployment insurance, it can be very expensive if you are unfortunate enough to lose your job for a shorter or longer period of time.