Get a better economy

Poor and unmanageable finances are something that many people lose sleep over, as it can take up a lot of time in everyday life. That's why we have 10 good tips for those who need a better and healthier personal finances.

1. Read your letters

The first step to getting out of debt is to address the problems. That's why you should always open and read your letters. Payment problems don't disappear with the window envelopes in the trash, instead, face the challenges head on and act accordingly.

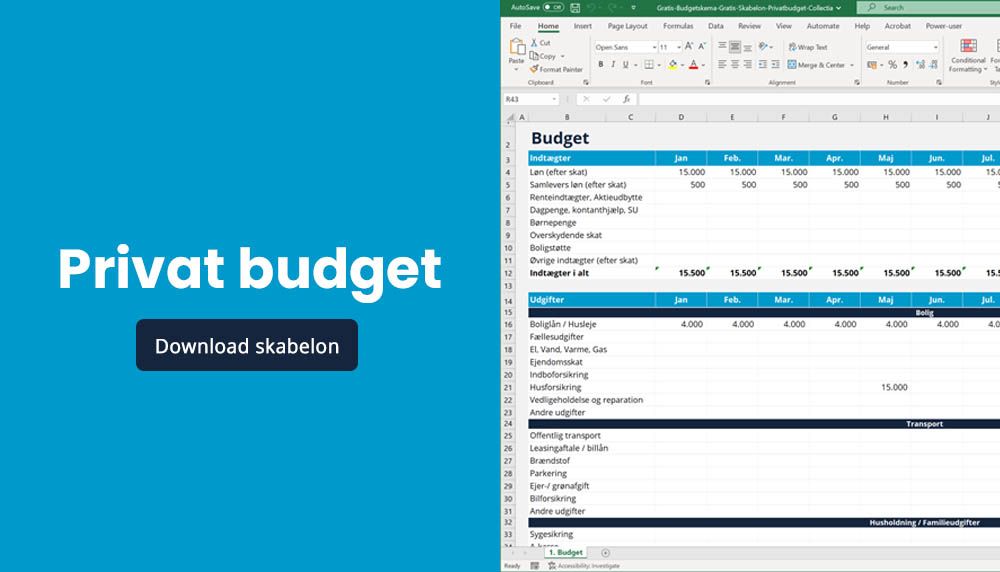

2. Get an overview of your finances

It is important to get an overview of your finances. How much do you owe and who do you owe money to? Make a concrete plan on how to pay off your debts.

3. Contact the creditor

It never pays to avoid the company you owe money to. Through constructive dialogue, you can find a manageable solution to repay your debt together.

4. Agree on an installment plan

If you are unable to pay all your debts at once, you can apply for an instalment plan and pay off your debts in instalments if your creditor approves this solution.

5. Switch your loans to cheaper loans

It is important that you convert expensive consumer loans with high interest rates into cheaper loans. Talk to your bank or lender about your loan restructuring options.

6. Do not take out new loans

When you pay off your debts, you are also on the road to restoring your financial health. Therefore, it is important to make sure that you adapt your lifestyle and spending habits to your financial situation. Therefore, avoid impulse purchases, buying on credit and taking out new loans to cover old debts.

7. Register bills for payment service PBS/Nets

Register your bills with PBS/Nets payment service. This way, you can get an overview and facilitate your financial management. However, it is your own responsibility to ensure that the payment is made, and you must therefore always monitor your account movements.

8. Find a solution so you don't end up in court

Always try to find a solution before your debt collection case goes to court. In a court case, you will have to pay a large number of additional expenses and legal costs.

9. Save up

Try, as far as possible, to put money aside each month for unforeseen expenses.

10. Get extra income

Paying off debt requires vision, persistence and hard work. You will get there faster if you supplement your income with extra income and cut out excesses and expensive spending habits.