Create a budget for 2024 now - and get your finances under control

Regardless of your financial situation, a budget is always a good idea, because without a budget you have no overview of your financial situation; your income and your expenses.

We recommend everyone, both individuals and businesses, to create a budget - but in this section we focus on the personal budget, with a special focus on those people whose overview and financial situation can be tough from time to time. This target group in particular can benefit greatly from having a budget - and sticking to it.

What is a budget?

A budget is an overview of your financial income and expenses. In personal finances, income is typically salary, public support, child support and other returns. Expenses are often the fixed and variable expenses you incur in your daily life; rent, bank loans - but also food, subscriptions and the like.

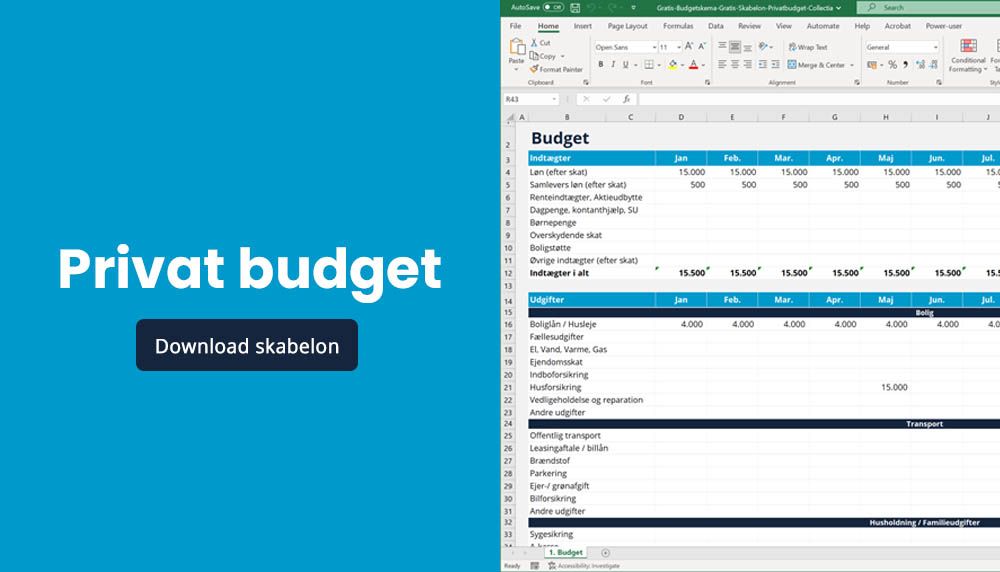

The budget can be sophisticated, but it can also be basically just a few fields in an excel sheet, it's entirely up to you - and what makes sense.

Why do I need to create a budget?

You need to create a budget to get an overview of your income and expenses, and while most people probably have a rough idea of what their monthly income is - few people actually know what their expenses are.

With a budget, you know when the electricity bill, child support or fixed car expenses will be deducted - and how much.

By knowing your income, and especially your expenses, you can manage your finances much better - and have an overview of when various expenses are due for payment. This allows you to manage your expenses in a much better way.

How do I create a budget?

You need to create a budget to get an overview of your finances and know what your basic income is - but more importantly, what you actually spend your money on - and how much.

We recommend that you create a budget in Excel, possibly using our budget template here.

The budget template is a good starting point for most individuals, regardless of their financial situation.

Who can use a budget?

Everyone can benefit from a budget, both businesses and individuals - but also their external advisors, banks and lenders.

If you are a private individual seeking a loan from a bank, you will often be asked for your budget so that the bank can get an idea of your financial situation.

How to get started with creating a budget

Use our budget template as a starting point if you are a private individual.

You then open your online bank, where all your expenses, every single month, going back a year, are listed.

Based on your online banking transactions, you can insert fixed expenses into your budget - some are fixed, some are variable, but insert them into the month they relate to.

This way, you can quickly get a better overview of your finances, including an overview of what each item costs and which ones you might be able to save on - or even cut out altogether.

Remember that when you have a new expense, it must be added to the budget.