Guide: How to contact a creditor, collection agency or lawyer

Many people who have unpaid debts or invoices to a creditor (typically a bank, company or individual) find that the creditor, creditor's lawyer or collection agency contacts them to get payment for their outstanding debt.

However, as a debt collection company and our customers, we find that many debtors sometimes find it difficult to reach out to their creditors and debt collection companies. This is completely natural and understandable, as it can be difficult to talk about finances, especially finances that you can't manage or pay.

We've put together a guide that gives you five tips on how to contact a creditor, a debt collection agency or a lawyer - if you're in default or have unpaid invoices.

1. Written contact is easier than phone contact

Most people who find it difficult to talk about finances with others often find it especially difficult when they have to talk about it in person, for example over the phone.

Therefore, for some people, it may be easier to send an email - or use the debt collection company's online access, where you can monitor your financial situation with them in peace and quiet. More and more debt collection companies are giving debtors online access to their cases, where they can communicate about their debt - or pay it.

2. It's not just about being able to pay off your debts right now.

Many people mistakenly believe that you should only contact a debt collection agency, a lawyer or your creditor if you can pay your debt right away. This is far from the case.

Most people are unable to pay their debts and therefore choose to avoid contact altogether. But this is the wrong way to handle the matter.

If you are unable to pay your debts now, most people will be understanding of this. Therefore, try to enter into a dialog about your financial situation and based on this, agree on what the next step is, e.g. installment plan, deferment or similar.

3. Get help - if you need it

For some people, getting a handle on their finances can be so difficult and overwhelming that they need outside help - perhaps even in the dialog with their creditors.

Fortunately, help is often not far away, and many municipalities offer debt counseling, for example. Friends and family can also be an option if you are unable to initiate the dialog with your creditors yourself.

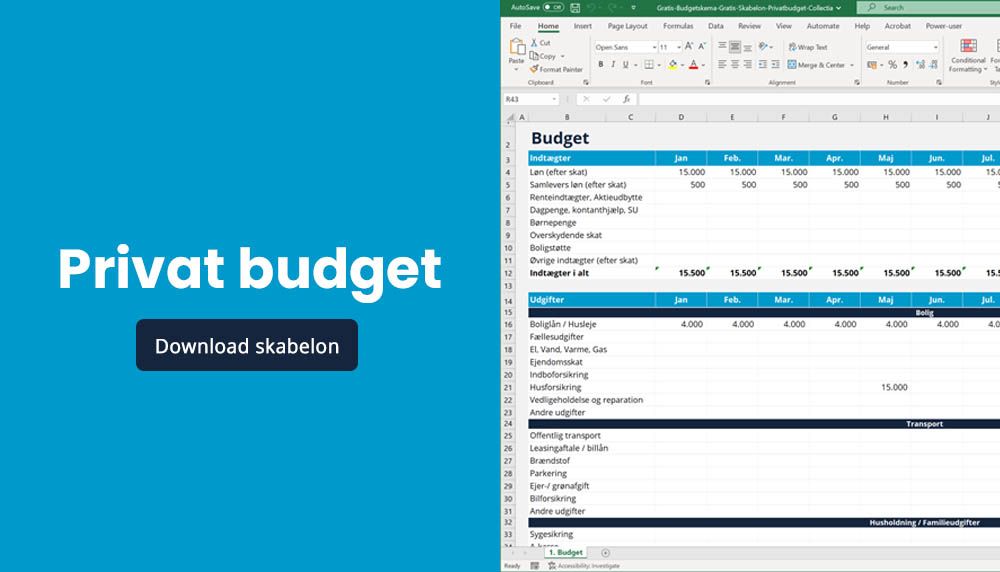

4. Create an overview with a budget

If you don't have a budget today, it's a good idea to create one. The budget doesn't have to be big or elaborate, but start by getting an overview of your income and expenses, month by month.

A prepared budget makes it easier to engage with your creditors. You can also send the budget to them to document your financial situation.

5. Dialogue is the best way to become debt-free

It's important to remember that, like you, your creditors want to clear unpaid debts.

Therefore, the best way to become debt-free is to always engage in a dialog with your creditors or collection agencies and overcome any fear of this dialog. Use the dialog to shed light on your financial situation and give the creditor the opportunity to relate to your financial situation, rather than just continuing to push for payment.

Through dialogue, you may be able to obtain a grace period, debt reduction, deferment or an installment plan.

Read more: