Personal finance for beginners - here are 7 concrete tips

At Collectia, we feel a social responsibility to help private individuals to a better economy. Therefore, we regularly publish articles with useful advice and professional content about personal finances that you can use in everyday life.

In this post, we highlight 7 concrete tips on personal finance for beginners - which we believe and hope will be of benefit to you.

1. prepare a budget

The very best thing you can do for your finances is to get an overview of them.

Without a complete overview of your finances, you don't know how many expenses you actually have. At the same time, you don't know how much money from your income you have left over when everything is paid for.

You probably know what your income(s) are. But do you actually know what you spend on groceries, transportation and other everyday pleasures? Probably not.

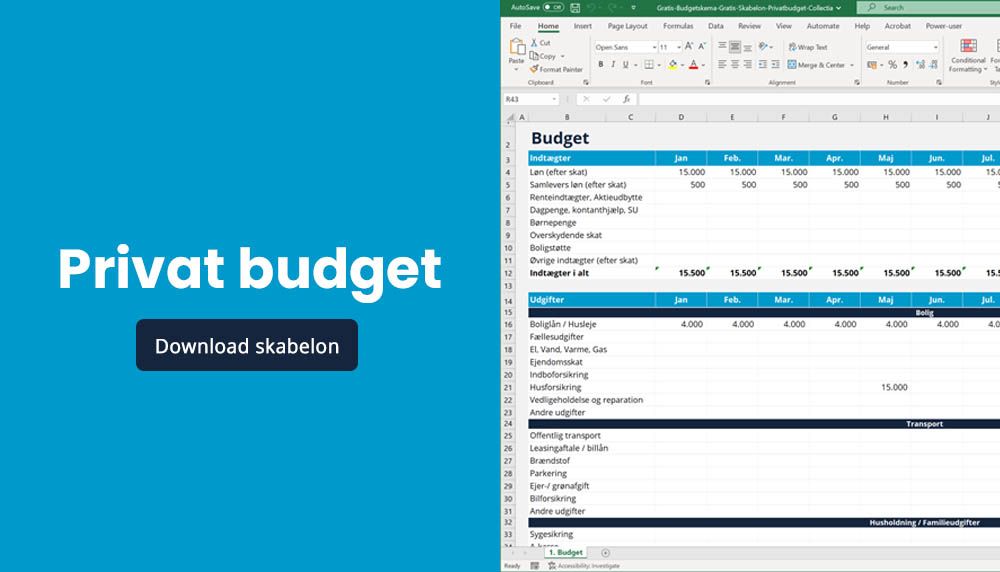

In other words, the best overview you can create is a budget. Start simple in Excel, for example.

We have prepared a personal budget template that you can download here for free:

2. Stick to your budget

Once you have created an overview of your personal finances through a budget, it is important that you stick to it.

It can be difficult, but try it anyway! Because if you stick to your budget, you will have your income and expenditure under control.

Should you run into unforeseen expenses one month, try to compensate elsewhere in the budget - if possible.

3. Set aside funds for contingencies

Most people forget it, but it's really important: setting aside funds for contingencies.

Few people get through an entire year without encountering expenses they hadn't planned for. These can range from a punctured bike to damage to your house or apartment.

That's why it's important to set aside funds in your budget for unforeseen expenses. This can be a difficult discipline, because how much should you actually set aside each month? Basically, of course, it depends on how many possessions you have; the more you have, the more you should set aside. But if you work on the basis of "a little is better than nothing" - you're well on your way.

4. Small print; beware of small expenses

Most people know what their rent and transportation costs are, but few have an overview of all the small expenses - and that's a shame. Because many people do not think about how big an impact the very small expenses for, for example, cigarettes, mobile subscriptions, streaming services and the like, have an effect on their overall finances.

For example, if you smoke a pack of cigarettes a day, that's more than €20,000 a year. And if you have just 2 or 3 streaming services, this is typically more than €5,000 per year.

Make sure you keep track of your expenses, even the small ones.

5. Regularly review your expenses

Most people know that they have many different expenses that they pay for each month. But many don't remember to review them regularly.

In many cases, you have a streaming service or other subscription that you don't actually use anymore. This is obviously money down the drain that you could have spent differently.

If you regularly review your small and large expenses, you will be able to take a position on them. Should you cancel some subscriptions and change others so that you pay less? Check the usage of your mobile subscription. If you are paying too much, you may be able to save money if you have the option of choosing a cheaper plan?

6. Dialogue with your creditors

If you are in a situation where you are in debt to a debt collection company or private company and are unable to pay the claim, our best advice to you is to enter into a dialog with your creditors. Because debt, regardless of its nature, is often expensive and costs money in the form of accrued interest and fees. Something you may be able to minimize, postpone or postpone if you choose to engage in dialogue - rather than ignore the letters.

7. There are some things you should not cut back on - it can have serious financial consequences

Although it may be tempting to save on your fixed expenses, it is important, however, that you do not, for example, save on your insurance or your expenses for, for example, unemployment insurance. Because should you suddenly find yourself in a situation where you need your insurance policies, it can often have serious financial consequences if you no longer have them.