Download free declaration of debt template

Most debt collection claims arise from an invoice or a promissory note/loan document.

However, most business owners don't realize that debt is not just debt - and the type of debt also affects when your claim legally expires. Generally, an invoice claim expires after 3 years - that is, 3 years from when you issued your invoice.

Other types of debt, such as a promissory note, only expire after 10 years. The same applies to statements of indebtedness. Therefore, it can be a great advantage to have a statement of debt drawn up for your customer so that your claim only becomes due after 10 years instead of 3 years. This gives you more time to recover your outstanding debt and can be an advantage if the customer is unable to pay at this time.

Why make a debtor declaration?

There are many good reasons to make an effort to sign a statement of debt with your debtor.

If the customer has indicated that they are unable to pay or repay your outstanding debt at this time, you can ask them to sign a statement of debt.

With a debtor declaration, you automatically get a longer limitation period on the claim - and thus a legally stronger basis for your claim than if it had been a simple invoice claim. By extending the extension period with a debtor's declaration, there is a chance that the customer's financial situation will improve over time and thus a greater chance of getting your outstanding financial debt paid - over time.

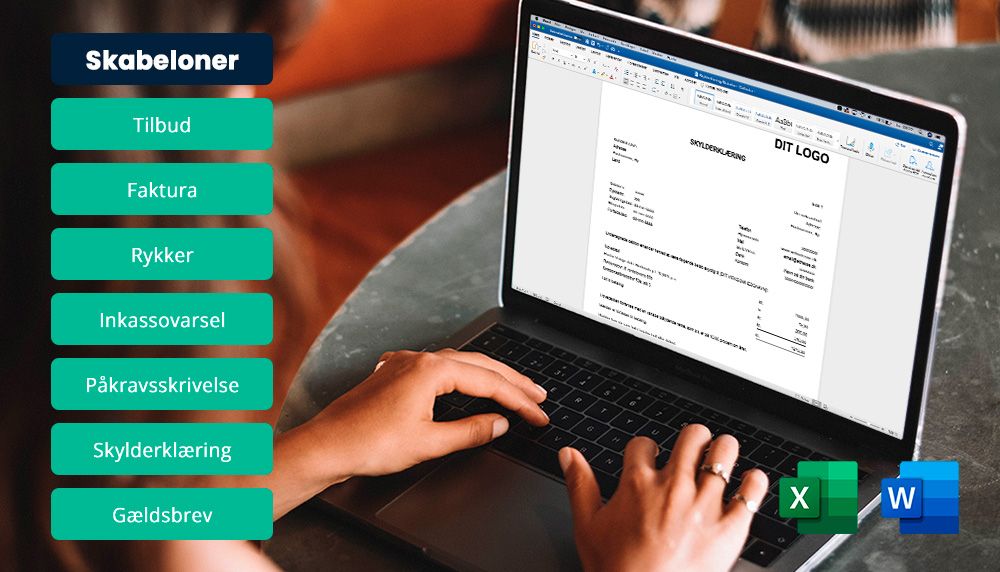

If you want to make a debtor declaration, we recommend using a debt declaration template so that you have all the formalities in place. A template ensures that you have a legally valid statement of debt.

Consequence of financial demands on the parent

If your claim becomes time-barred, you can no longer claim it from the debtor, and you cannot make use of debt collection - neither debt collection companies, lawyers nor the courts.

We therefore always recommend, where possible, that a statement of debt is drawn up. The statement of debt has basically the same legal effect as a judgment in the enforcement court; a foundation for a claim that is not only statute-barred after 3 years - but as much as 10 years.

Download the free template below

By using our free debtor declaration template, you ensure that all legal formalities and requirements are met in order to have a legally valid debt declaration.

You can download our free debtor declaration template below. You are welcome to design or set up the template yourself to fit your company's design and layout.

Download your template

By filling in and submitting this form, you will be subscribed to our newsletter. Our newsletter brings you useful information on debt collection, debtor management, finances and advice on how to avoid bad payers. You can unsubscribe from the newsletter at any time.

FAQ: Frequently asked questions about debt declaration

A statement of debt is a declaration from the debtor to a creditor, where the debtor declares that the person or company acknowledges one or more amounts owed - for example, a missing invoice.

The advantage of a statement of debt is that you as a creditor have a significantly better claim against the debtor than if the claim was simply an unpaid invoice.

A statement of debt has basically the same weight as if you had a judgment against the debtor.

If you have a statement of debt, the claim becomes statute-barred after 10 years - where the statute of limitations on a simple claim (such as an invoice) becomes statute-barred after 3 years.

If your statement of indebtedness is not filled out legally correct by both parties, you as a creditor may risk it not being valid.

We therefore always recommend using our statement of indebtedness template so you know that all legal formalities are in place.

With our debtor statement template, you have a great example of what your debtor statement could look like. You do not have to use our example 100% and you are free to change the design, appearance and layout.

We do not recommend that you change the wording in the example.

More free templates:

Debt collection notice template

Disclaimer: This article/template is for informational purposes only and should not be considered legal advice.