Effective debt collection - get paid for your services with Collectia

Let a professional debt collection company help you get your money back through effective debt collection. We understand and respect that you naturally want to be paid for your service when you have delivered a piece of work - without ruining the relationship with the customer.

Collectia offers you a full-service debt collection solution that handles everything related to debt collection for you. We can handle everything from sending invoices, reminders and collection notices to handling legal proceedings, foreclosure and ongoing monitoring of your debtors. In addition, we can also help minimize the number of unpaid invoices by providing accurate credit assess ments of existing and potential customers.

What is debt collection?

Debt collection is a process that can be initiated by a creditor, the creditor's debt collection company or the creditor's lawyer. The purpose is to recover the money owed to the creditor for goods or services provided when one or more invoices have not been paid on time.

The debt collection process involves a series of steps that the creditor or their debt collection agency takes to recover the money owed by the debtor. These steps may include, among others:

- Reminder letters

- Imposition of interest and fees

- Call to debtor

- Physical presence at the debtor's premises

- Set up and manage an instalment plan

- Registering a debtor as a bad payer

- Legal actions in cooperation with e.g. the bailiff court

- Attachment of debtor's property, assets and belongings

Debt collection is the process a creditor or a creditor's collection agency undertakes to recover money from a debtor. The process typically includes reminder letters, phone calls, physical appearances, charging interest and reminder fees, or whatever the debt collection company deems appropriate within the law. The enforcement court may also be involved in the debt collection process; this is often referred to as judicial debt collection.

Extrajudicial debt collection

Extrajudicial debt collection is a term for handling debt collection cases that take place outside the court system. If Collectia is used, the process will include sending reminders/collection notices, contacting the debtor directly (by phone and in writing), sending debt collection letter, entering into an installment agreement or composition agreement, reporting to RKI, etc. If it is not possible to reach an agreement with the debtor, the case will be transferred to domestic debt collection.

Reminder letter - As a trader, you may send a maximum of 3 reminders with a reminder fee of DKK 100 per letter. In each reminder, the creditor must state that the debtor is given a payment deadline of at least 10 days. Please note that reminders must be sent on a valid basis. If the debtor has objected to the claim, the creditor is generally not allowed to continue or start sending reminders.

Debt collection notice - Before sending an invoice claim to debt collection, a debt collection notice must be sent to the debtor in accordance with debt collection legislation. This warns the debtor that any non-payment may result in their outstanding debt being sent to debt collection, which will result in additional costs. The debtor must again be given at least 10 days to pay.

Opposition - If a debt is to be sent for collection, there must be no doubt as to whether the debtor opposes the claim or not. If the debtor has indicated that they do not want to pay or that the product delivered does not meet their expectations, the recovery cannot be pursued as a normal debt collection case. Instead, it must be handled through the courts.

Domestic debt collection

Unlike out-of-court debt collection, in-court debt collection includes all "debt collection activities" that involve the courts. The claim will therefore, in agreement with the creditor, be handed over to the court. In addition to recovering the money and sending a signal to your customers, the purpose of this process is to secure the creditor's claim against the debtor by interrupting the statute of limitations on the claim. The processing can either take place in the ordinary courts(payment demand/subpoena) or in the bailiff court (bailiff requisition).

For debt collection cases with a principal amount of less than DKK 100,000, the domestic processing takes place via the small claims process, where you can send a case to court by filing a payment demand. If, on the other hand, the principal amount is more than DKK 100,000, a summons is filed with the ordinary courts.

The legal process concludes with a judgment against the debtor (by summons) or an endorsement - also known as a U-judgment in the case of a demand for payment. This serves as a foundation for the case, securing the claim and allowing the actual enforcement to begin. After receiving a judgment, you can choose to send the case to the enforcement court, where it is possible to seize the debtor's assets. In addition, a bailiff court meeting gives you the opportunity to meet the debtor, as you are obliged to attend a bailiff court meeting.

You can quickly create your cases via our user-friendly online platform. Simply upload a picture of your unpaid invoice - our smart scanning engine will take over and create the case for you.

If you prefer to create it manually, this is of course also an option.

According to the current legislation, you may send a maximum of 3 reminders with a reminder fee of DKK 100 incl. VAT.

This means that you cannot send a single reminder with a penalty of DKK 300.

As we have several different solutions, the price of our service varies. Choose the solution that suits your needs! We have a free solution, one where you pay a lump sum and a subscription solution.

One, is for you if you have a single unpaid invoice. We charge a small set-up fee and receive just 10% of the principal amount when we collect your money.

Plusis our debt collection subscription. This is suitable for those who expect to send several cases during the year. Here we live off the costs we impose on the debtor, as we get 0% of the principal amount.

Pro is designed for you if you want to spot bad payers in time through effective credit ratings of your customers and suppliers. When you choose Pro, you get access to our credit rating platform, Qatchr.

If your customer submits a dispute, it means that they do not agree with the invoice sent to them. They therefore do not want to pay for the goods or services provided.

There can be many reasons for this. They may not be aware of the invoice, the work/service has not been carried out correctly, the amount is not as agreed, etc.

Unfortunately, the legislation is structured in such a way that you are not allowed to send an invoice for collection if your customer disagrees with the claim and has therefore lodged an objection. You must therefore first clarify whether the customer's objection is genuine or not.

If the objection is received after the case has been sent for recovery, the case will be temporarily stopped and we will start to clarify the objection.

If your customer's objection is not upheld, the case will be restarted. Conversely, if the customer is successful, the case will not continue.

An unpaid invoice must be sent to debt collection when the claim is in default, i.e. when the invoice's payment deadline has passed.

Before a case can be sent for collection, the creditor or their collection agency/lawyer must have sent a collection notice with a payment deadline of at least 10 days.

Many companies also choose to send 1-3 reminders before initiating debt collection. However, this is not a requirement, but merely an option available to the creditor.

If the debtor is not notified of debt collection at least 10 days before the start of the debt collection process with a debt collection notice, debt collection cannot be initiated. The requirement for debt collection notices also applies if the case is to be brought before the enforcement court, without a debt collection agency or lawyer.

If you disagree and have thus objected to the creditor's claim, debt collection can generally not be initiated or continued until the disagreement is resolved.

A disagreement over a claim can cover anything from a simple misunderstanding, such as under-delivery of an order, to complex construction issues.

Therefore, whether you are a debtor or a creditor, it is always important to have proper documentation of the order, sale or delivery so that both debtor and creditor can prove their case.

If there is a dispute over a claim, it will be possible to get the court's help to move forward in the debt collection process, although this often results in additional costs for both parties.

If you don't agree with the debt collector's demands, make sure to contact the debt collector as soon as possible.

Many people, for various reasons, choose to ignore debt collection companies and debt collection lawyers in the hope that the problem will go away.

But that's not the case. On the contrary, the costs are higher for you as more interest and fees are added.

As a debt collection company, we always recommend that you respond to inquiries from the creditor, the creditor's debt collection company or lawyer. By actively engaging in a dialog with the creditor, there may be an opportunity to establish an installment plan, interest freeze or another solution.

If you are unable to pay the claim for whatever reason, be honest - often all parties are only interested in finding a solution to the dispute.

Many companies, large and small, experience during the financial year that one or more payments are missed, and the reason can be very many. Whatever the reason, you should take action on the problem, either by sending out reminders, debt collection notices, or let Collectia handle debt collection for you. Because debt collection is ultimately a question of the bottom line.

With Collectia, you get a full-service debt collection product that includes everything you need to get your money back - from sending invoices, reminders, collection notices, communication with the debtor and even the enforcement court. At Collectia, more than 160 employees are ready to help you with your debt collection cases, regardless of whether you have a few or many cases, and regardless of the size.

We help some of Denmark's largest companies and groups with their debt collection to the local florist. This experience has made us one of Denmark's largest debt collection companies when it comes to professional, efficient and inexpensive debt collection. Our many years of experience in debt collection ensures you a high resolution rate, low prices and a professional and respectful handling of your case.

We have a 100% digital platform, where we are the only ones in Denmark to allow our customers to create their case(s) for debt collection, without any hassle. On our online dahsboard you can follow your case, the actions that happen and be updated with the latest actions, questions and communication to your debtor.

Debt collection is essentially a conflict between two parties, a debtor and a creditor - a conflict that we here at Collectia do everything we can to help you as a creditor. Our more than 270 employees handle your case using the latest technology and digital tools to get your money back.

We have some of the cheapest debt collection solutions in Denmark compared to both other debt collection companies and debt collection lawyers. We have prices that are adapted to all types of companies and organizations, regardless of size. You can read more about our prices here.

At Collectia, we have no requirements for the amount. You decide how many and how large cases you want to send to debt collection. Today, we handle cases from a few hundred to several hundred thousand kroner.

As a starting point, we do not offer to invoice buy single claims. We work with "fresh" cases and have an organic approach to our business.

However, help can be found elsewhere. For example, the company Svea Finans offers both invoice purchasing and portfolio purchases.

Create your debt collection case today

Creating your first debt collection case is incredibly easy. Simply register here on the website, which will only take a few minutes. After registering, upload a photo of your unpaid invoice and we'll take care of the rest!

-

Quick and easy

-

Sign with MitID

Become a customer

Choose a solution and complete registration

Create a case

Create a case via Customer Web or take a picture of the invoice with your mobile phone

Payment

Payment to you will be made as the case is recovered.

Recovery

Recovery process starts

Credit score your customers and suppliers!

Safe and profitable trade starts with an accurate credit assessment

Avoid credit losses on bad payers and bankrupts with credit checks at your fingertips. On our new online platform, Qatchr, you can quickly check the creditworthiness of your customers and suppliers. Do your business a favor and create a free account today.

Prices for our debt collection solutions

We have a solution for every need, with no requirements on invoice size or number of cases.

If you have any doubts, please give us a call. We are ready to help you get started.

- One

-

-

Number of cases | Pay per case

-

Creation of a case | 395 kr.

-

Price per month. | 0 kr.

-

10% is settled upon recovery

- More

- Most people choose

-

Number of cases | Unlimited

-

Creation of a case | 0 kr.

-

Annual subscription

-

0% settled upon recovery

- Pro

-

-

Same benefits as Plus

-

Credit rating of companies

-

Monitoring of enterprises

-

Credit checks for private individuals

A complete debt collection solution

Support

Contact us every weekday 08.30-15.30 on tel. 77301480 or email salg@collectia.dk

Invoice service

We can send your invoices on time, register payments, clear and reconcile your accounts

Credit rating

Secure and profitable trade through accurate credit ratings via Qatchr

Jerk

We send out reminders that are legally designed in accordance with the law

Collection notice

Debt collection notice is sent to the customer, notifying that the case will be transferred to the debt collection process

Debt collection

Tired of bad payers? We ensure you a respectful and consistent recovery.

Outbound

We make personal calls to the debtor in order to conclude a payment agreement

SMS pay

SMS with payment link - with a simple 'swipe' your money is collected

Case portal

Our online case portal gives you an overview of all your cases

Mobile compatible

Get an overview of your cases and create new ones by taking a picture of your unpaid bill

Judicial recovery

If the debtor does not pay during the collection process, we can take legal action

Instalment plans

If the debtor cannot pay the full amount at once, we can offer to set up an instalment plan

Registration in the RKI

We make sure to register your customer in RKI if payment is not received

Recovery abroad

We can help you recover your receivable even if your customer lives abroad

Surveillance

Let us monitor your customers and follow up on your receivables on an ongoing basis

Data washing

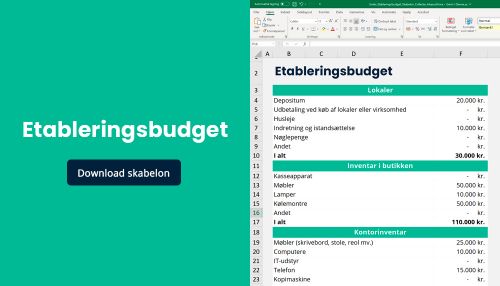

Free material for the trader

Economic overview

Our online platform provides a complete financial overview of your cases. Here you can find case history, register payments and get a complete overview of the recovery process.

Follow on your mobile

Our system is optimized for both tablet and mobile. With your device in hand, you can create a new collection case in seconds. Simply take a picture of your unpaid bill.

Integration to your preferred ERP system

Power up your recovery

To make everyday life even easier for business owners, we have integrated with several of Denmark's favorite ERP systems. Do we also integrate with your accounting software or inventory management system?