Invoice

An invoice is a document sent by a company specifying a purchased good or service for which payment is required.

The invoice contains the goods purchased and any payment requirements.

For an invoice to be valid, it must comply with certain rules. Find out more about the rules for invoicing below.

What is an invoice?

An invoice is often referred to as a bill, which is typically created using an accounting program. The invoice or bill can be described as a document and a statement of the products or services that have been delivered and for which payment is due. In other words, the invoice is documentation for both debtor and creditor regarding a transaction.

Basically, there are two types of invoices for a company: a purchase invoice (incoming invoices) and a sales invoice (outgoing invoices). Regardless of the type of invoice, companies are required by the Danish Bookkeeping Act to keep all accounting material, including invoices, for 5 years. Private individuals have no obligation to store invoices, but it is recommended to store invoices at least within any warranty or complaint period.

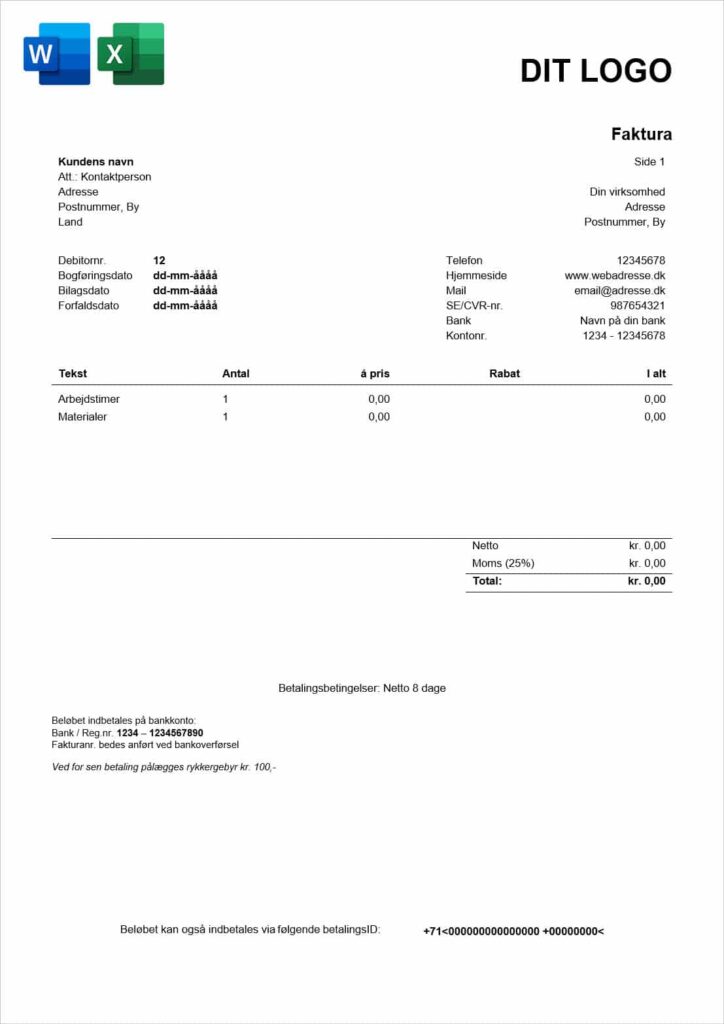

Invoice template - download it for free

We have created an invoice template that you can download and use for free. It contains all the data points you need. This ensures that you send out legally valid invoices.

What are the requirements and rules for invoicing?

As mentioned above, an invoice is used as documentation for both buyer and seller, and for this documentation to be valid, certain conditions must be met.

Requirements for an invoice can be found at SKAT and in the Executive Order on Value Added Tax §58 (chapter 12 "Invoice requirements") - commonly referred to as the VAT Order.

If your company uses the accounting programs Billy, Dinero, e-conomic or Microsoft Dynamics 365 Business Central, you can generally assume that your invoices comply with all the rules and requirements for an invoice.

Basically, there are 6 things you need to include on an invoice

- Invoice date (Date of issue of the invoice)

- A sequential invoice number (so you can identify the claim)

- Seller's CVR/CPR no.

- Name and address of the seller

- Quantity, nature, scope of the product/service provided

- Tax base (VAT base)

The more information that appears on a bill, the better documentation it is for the buyer, the seller and the tax authorities.

Obsolescence of an invoice

What many companies unfortunately don't realize is that an invoice, and thus its potential debt collection claims, can become obsolete.

An invoice generally expires after three years from the time when a seller could have expected to have sent the invoice. In other words, if a company sends an invoice one year after the work has been done, the three-year limitation period does not apply from the due date, but one year earlier.

The statute of limitations for invoices is regulated in the Danish Limitation Act, and section 2 of the Limitation Act states: "the limitation periods are calculated from the earliest point in time at which the creditor could demand that the claim be fulfilled".

If, like most other businesses, you send your invoices after the product has been delivered or the work has been carried out, the limitation period applies from the due date on the invoice.

If you want to extend an invoice, this is legally known as interrupting the statute of limitations. Interrupting the limitation period is done with the help of the court, through a promissory note or a promissory note. If you obtain an interruption of the limitation period through a promissory note, declaration of debt or with the help of the court, an invoice will generally no longer become time-barred after 3 years - but after 10 years.