Download free promissory note template

A promissory note is a legally binding document between two parties: a lender and a borrower. These documents are common both between private individuals and in connection with loans from banks or mortgage lenders.

Although banks and mortgage companies often refer to promissory notes as loan documents, both terms refer to a written agreement for a loan. The term "promissory note" is also used but is less common.

At the bottom of this page you will find a template for a promissory note that we recommend using as a starting point, unless you already use a template.

What is a promissory note?

A promissory note is a legal document that details a loan and all relevant information about it. It serves as proof of both the loan's origination and the agreed terms, such as interest, repayment and repayment. Promissory notes are often also referred to as loan documents.

What does a promissory note contain?

There are no formal requirements for what a promissory note must and can contain, but the promissory note should contain:

- The size of the loan

- The identity of the lender and borrower (full name, address, CPR/CVR number).

- Interest rate information and accrual frequency.

- Conditions in case of loan default.

- The date the loan was taken out.

- Installment size, installments, and frequency.

- Signatures of the parties.

It is crucial that the document clearly states a debt relationship to avoid SKAT considering the loan as a gift. Without the signatures of both parties, the document is not legally binding.

Therefore, always make sure that the document is signed by both parties - without signatures, the document is not legally valid.

If there is any other relevant information that the lender(creditor) or borrower(debtor) considers relevant to the loan, such as the currency in which the loan is settled or similar, this should also be included

At the bottom of the page you will find our template for a promissory note that also includes the above points.

Why do I need a promissory note?

A promissory note, also known as a loan document, acts as a security for both lender and borrower. It ensures that the loan is taken out, settled and repaid according to the agreed terms.

Without a promissory note, both parties risk lacking the necessary documentation for the loan agreement, which can lead to misunderstandings or conflicts about the loan terms.

A promissory note accurately documents the loan amount, interest rate, repayment amounts and how often these installments are to be made. This ensures clarity and mutual understanding between the parties.

In addition, the promissory note serves as a legal foundation in the event of debt collection proceedings if the loan is not settled as agreed. By having a promissory note, both parties have a firm legal basis to rely on.

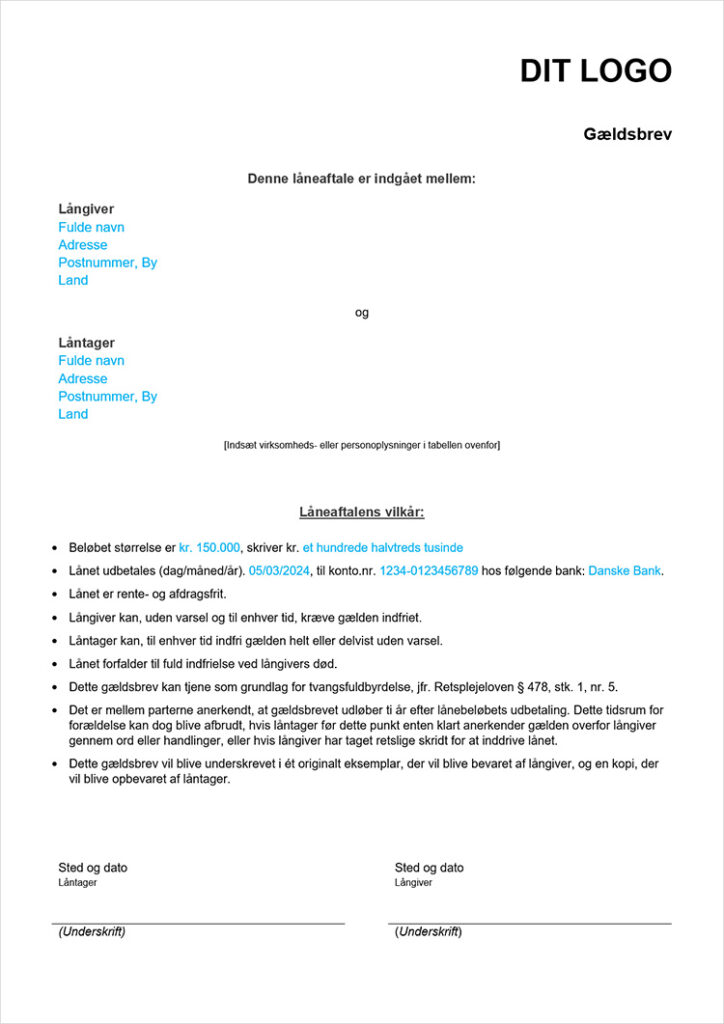

Example of a promissory note

There are no formal legal requirements for the design of a promissory note. This means you have the freedom to design, write and structure the promissory note to suit your needs. However, we recommend that you base your promissory note on the key points mentioned earlier and include any additional information that the lender and borrower deem relevant.

In its simplest form, a promissory note can be so concise that it fits on a single A4 sheet of paper.

In the section below, you'll find a link to our free promissory note template, which provides an example of how a promissory note can be drafted.

Debt Letter Template

By filling in and submitting this form, you will be subscribed to our newsletter. Our newsletter brings you useful information on debt collection, debtor management, finances and advice on how to avoid bad payers. You can unsubscribe from the newsletter at any time.

If you don't yet have a promissory note, it's a good idea to start with a template.

At Collectia, we have created a template that you can use for your promissory note, promissory note or loan document. Feel free to customize, use and modify the template to meet your needs.

Please note that it is not allowed to share the template with anyone other than your borrower. If you wish to share the template, you are encouraged to refer interested parties to this page to download their own copy.

We hope you enjoy using the template for your next promissory note.

Advantages of a promissory note

Drafting a promissory note brings many benefits to both parties in a loan agreement. Besides providing clarity and ensuring a common understanding of the terms of the loan, a promissory note can also have other benefits:

- Legal security: A signed promissory note acts as a legally binding document that can be used in court if a dispute arises over the loan. If the loan is not repaid as agreed, the lender can use the promissory note as proof of the existence of the loan and the agreed terms.

- Avoid tax problems: Without a promissory note, loans between private individuals may be considered gifts by the tax authorities, which can result in tax liability. Having a promissory note in place ensures that the loan is not mistaken for a gift.

- Prevent misunderstandings: Many conflicts can arise due to a lack of clarity about the terms of the loan. A well-drafted promissory note ensures that both parties agree on the interest rate, repayment deadlines, and any penalties for defaulting on the loan.

Challenges and pitfalls of promissory notes

While a promissory note can be a practical solution, there are also some pitfalls to be aware of:

- Loan default: If the borrower does not comply with the payment agreements , the lender may end up in a difficult situation, even if there is a promissory note. Collection processes can be time-consuming and costly, and it can take a long time to get your money back – if at all.

- Deficiencies in the document: If the promissory note does not contain all the necessary information or is not signed by both parties, it may not be recognized as legally binding. It is therefore important to be thorough and ensure that the document meets all formal requirements.

- Personal relationships: Loans between friends or family can create tension if there are disagreements over payment or terms. Although a promissory note formally protects both parties, it can be challenging to maintain a good relationship if the borrower finds it difficult to pay back.

The role of the promissory note in the debt collection process

A promissory note can be crucial if the debt needs to be recovered through debt collection. In such cases, the signed promissory note can be used as proof that an agreement has been made for the loan. The lender can therefore present the promissory note to a debt collection agency, which will take the necessary steps to recover the amount owed.

The debt collection process can involve several stages, including payment reminders, negotiating repayment arrangements and ultimately legal action if the loan remains unpaid. With a promissory note in hand, the lender is in a strong position in this process as it clearly states what has been agreed and when payments are due.

How to draft a promissory note correctly

When drafting a promissory note, it is important to follow certain guidelines to ensure that the document is clear and legally binding. Here are some tips on how to draft a promissory note:

- Be precise: Make sure that all relevant information about the loan is included in the document. This includes the size of the loan, the interest rate, the payment frequency and any installments.

- Use a template: If you're not sure how to word a promissory note, a template can be a good starting point. It ensures that all necessary information is included and that the document is structured correctly.

- Get help if necessary: If the loan is of a significant size or if there are complex terms, you may want to get help from a lawyer or financial advisor to draft the promissory note.

Disclaimer: This article/template is for informational purposes only and should not be considered legal advice.