Free budget form - Personal budget template

Collectia has as a debt collection company since 1998 helped hundreds of thousands of Danes with their debt situation, unpaid invoices and unpaid loans. Collectia currently employs about 150 employees, all of whom work hard to ensure that you have a good experience with debt collection - and that you get out of debt as quickly as possible.

As a responsible debt collection company, we feel a special responsibility to advise, guide and help Danish families and individuals with their financial situation. As a debt collection company, we believe that the best results are achieved through dialog, mutual respect and understanding - between all parties.

Make a budget

Unfortunately, we are seeing an increasing tendency for debtors to lose track of their finances - and thus their debt situation.

If you're in a situation where you want to rectify your financial situation, our best advice is to get an overview of your finances - and a simple budget is the place to start.

A budget provides an overview of your income and expenditure, giving you visibility on how you spend your money.

Once you have an overview of your financial situation using the budget, you can budget month by month and know exactly what you have in terms of income, expenses and any disposable income once all fixed expenses are paid.

Debt collection is a process for those who find that one or more claims (typically an invoice) have not been paid on time - and now want to collect this debt. Basically, authorized debt collection companies, all lawyers and you can carry out debt collection - as long as you comply with the applicable legislation on interest and debt collection.

In the debt collection process, you, your debt collection company or your lawyer can, among other things; make calls to the debtor, establish an installment plan, add interest, impose reminder fees, compensation fees and in some cases, pursue legal debt collection through the enforcement court - all with the aim of getting the debtor (debtor) to pay your receivable.

What should a good budget contain?

A budget can be set up in many different ways - and with many different calculations. We recommend that you create your budget digitally, for example using Excel, so you can easily correct and update your income and expenses on an ongoing basis.

The main purpose of a budget is to give you an overview of your finances - and thus also as a financial management tool for you in your daily life.

We recommend that you start by reviewing all your existing or upcoming expenses.

If you find it difficult to know exactly what you spend on expenses such as transportation, food or other expenses that may vary from month to month, a starting point is to take an average of the last 12 months' expenses (Example: Total transportation expenses over 12 months / 12 = average per month) - if these 12 months are representative of your expenses and there have been no unforeseen expenses.

Once you have an overview of your expenses, you are ready to start creating a budget.

Your expenses are likely to vary greatly from month to month - some months will have expenses such as insurance, green tax, etc. That's why we always recommend that a budget shows all 12 months.

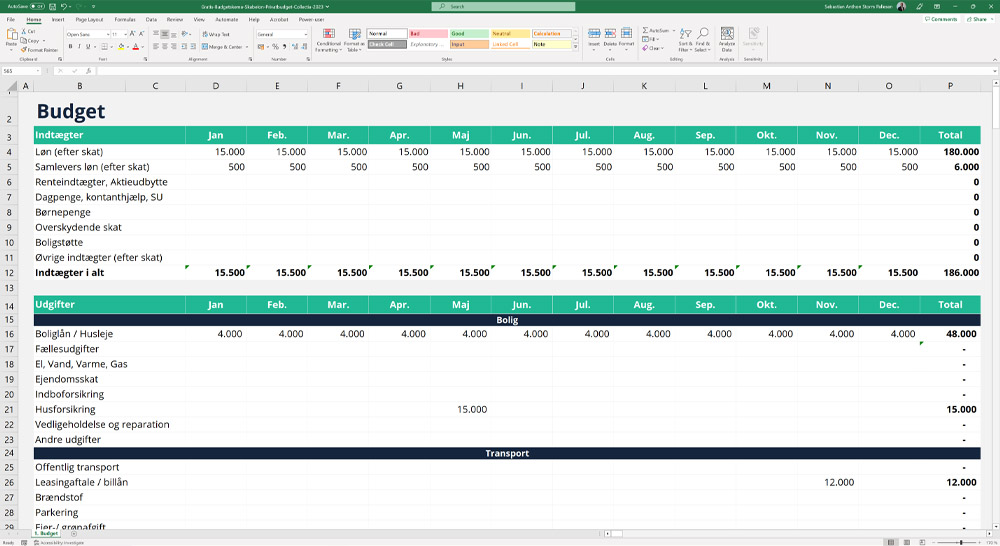

Example of a budget

There are many good examples of a budget online and in various books on the subject. However, we recommend that you make a simple budget that contains your income after tax - minus all your expenses. This should be done month by month.

We have created an example of a budget in Excel. Download it for free here →

In the example, we have created a budget for a budget account where two fictitious people, Anne and Anders, each pay DKK 5,000 into the account, a total of DKK 10,000 per month. All joint expenses that Anne and Anders have are deducted from this account. This could also have been their paid salary.

Should Anne and Anders be lucky enough to have more income in a particular month, they simply correct the fields below the month in question.

After this, you will see a long list of all Anne and Anders' fixed expenses - car loan, unemployment insurance, gasoline, TV package, etc. - that they have every month, every quarter or every six months or maybe every year. If you have more expenses, just add a line below.

Below the expenses is a total figure that gives an overview of all of Anne and Anders' fixed expenses each month.

In this budget, we have chosen to run the non-fixed costs (so-called variable costs) alongside the fixed costs. Non-fixed expenses are expenses that you had not budgeted for and therefore do not have to be paid on a fixed monthly or quarterly basis. Examples of non-fixed expenses include clothes, entertainment, vacations or a new washing machine if the old one breaks down. Remember to budget for the possibility of unforeseen costs - even if it's hard to pinpoint exactly.

Then, all expenditure (fixed and non-fixed) is aggregated in 'Total expenditure'.

At the bottom of the budget, we compare income (your paid salary, and in this case, what Anne and Anders have chosen to transfer to the budget account), with total expenditure (fixed and non-fixed costs).

In this example, you can see that some months Anne and Anders have a surplus, while other months they have a deficit - but overall over the year they have a surplus.

An overview of the economy has now been created, and thus a management tool for, month by month, how income and expenses relate - and thus which months there is room in the budget and which months there is less room in the budget.

Do you have unpaid debts?

When you take stock of your finances and spending, you are likely to come across unpaid invoices and old debts - and perhaps letters from debt collection lawyers or debt collection agencies.

It can often be difficult to get to grips with your financial situation, especially if it's not what you want it to be. In Denmark, unpaid invoices and old debts often increase by around 8% a year - so if you don't do anything about your debts, you risk just owing more, day by day.

We therefore recommend that you contact your creditors, lawyers or debt collection agencies - and start a dialog about settling your debt. Both debt collection lawyers and debt collection companies will in many cases be willing to look at an installment plan if it is possible.

You can use your budget as a starting point and present it to them - this way you can make your finances visible and, together with your lawyer or debt collection agency, make a plan to pay off your debt - and avoid it increasing further.