Free profit and loss budget template

A performance budget is a budget that shows the expectations for the coming financial year or period. The performance budget should provide an overview of the company's expected costs and income.

The items in the budget can vary; the larger and more complex the company, the more complex the performance budget often is. Some companies choose to have a performance budget for each department/area, which is then used as a management tool.

The performance budget is also called an operating budget by some, but it's basically the same thing.

Why create a profit and loss budget?

There are many good reasons why your business should have a profit and loss budget. With a profit and loss budget, you can get an overview of expected income and expenses, giving you control and management of your company's finances.

In addition, external parties, such as banks and other lenders, may request a profit and loss budget in connection with loans, guarantees, collateral or similar. This is often requested in connection with a balance sheet.

How to create a profit and loss budget

There are many ways to create a profit and loss budget. Basically, it's all about estimating the items in it, both the expected income and expenses. Estimating can be tricky, but often it's about doing the best you can with the information and any historical data available.

If you're a company in operation, it will generally be easier to look into historical data, sales, revenue and periods, while new companies can often find it difficult to estimate, as the information is not available to the same extent.

Always make sure to include as much knowledge as possible when estimating your profit budget items; take into account the outside world, market expectations, customer expectations, cost expectations, interest rates and the like.

The performance budget can be broken down in a number of different ways, depending on the needs and preferences of each business. While some prefer to break it down on an annual basis for a broader, overall view, others choose to break it down quarterly or even monthly. Breaking it down on a quarterly or monthly basis allows for more detailed and ongoing monitoring. This can be particularly useful for keeping an eye on how the performance budget matches up with the realized data and allows for more accurate and timely management. While a quarterly breakdown may provide a less detailed picture than a monthly breakdown, it can still be more nuanced than a year-based budget, which can make it easier to use as an effective management tool throughout the year.

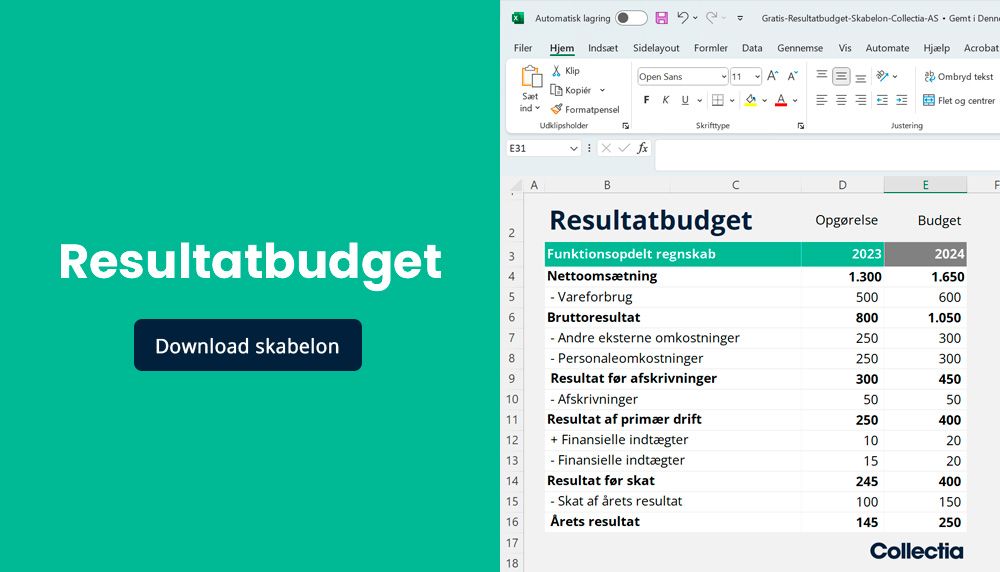

Free profit and loss budget template

If you're about to create a profit and loss budget for your business, you can use a template. This will save you a lot of work.

Here at Collectia, we have created a template for a profit and loss budget that you as a company are free to use.

The template is free and contains the most common items you need to get started. You can design, edit and change the template as much as you like to adapt it to your needs and use. Please note that you are not allowed to share the template with others - instead, encourage them to download it here.

Download Template

By filling in and submitting this form, you will be subscribed to our newsletter. Our newsletter brings you useful information on debt collection, debtor management, finances and advice on how to avoid bad payers. You can unsubscribe from the newsletter at any time.

What does a performance budget contain?

A profit and loss budget basically contains the items that reflect your accounts, divided into groups.

As a minimum, a performance budget should include:

- Turnover (sales of goods, services and similar)

- Variable costs (costs that vary with sales)

- Fixed costs (fixed costs like rent, etc.)

- Depreciation (depreciation of equipment, machinery, real estate, etc.)

- Financial income and expenses (interest income and interest expenses from the bank, lenders and the like)