Letter of Claim

What is a letter of formal notice?

A letter of demand is a legal letter from a creditor (or the creditor's collection partner) to a debtor, drawing attention to an amount owed that is now sought to be paid.

In everyday language, a demand letter is also known as a demand letter, a §10 letter, a debt collection letter or a debt collection notice.

The demand letter is regulated in section 10 of the Debt Collection Act.

Why is a letter of formal notice sent?

In order for debt collection to be initiated, a letter of demand must be sent informing the debtor of the amount owed and giving the debtor a deadline of at least 10 days to pay the claim.

If this does not happen, the company then has the option of starting the debt collection process, either through self-collection or third-party collection, i.e. collection with the help of a debt collection agency or a debt collection lawyer.

There is no requirement for the creditor to send the demand letter themselves, but typically your debt collection agency or lawyer will be happy to do this for you.

A reminder fee may be imposed on a demand letter, as well as a compensation fee if the debtor is a trader.

The demand letter may only be sent after the payment deadline has expired.

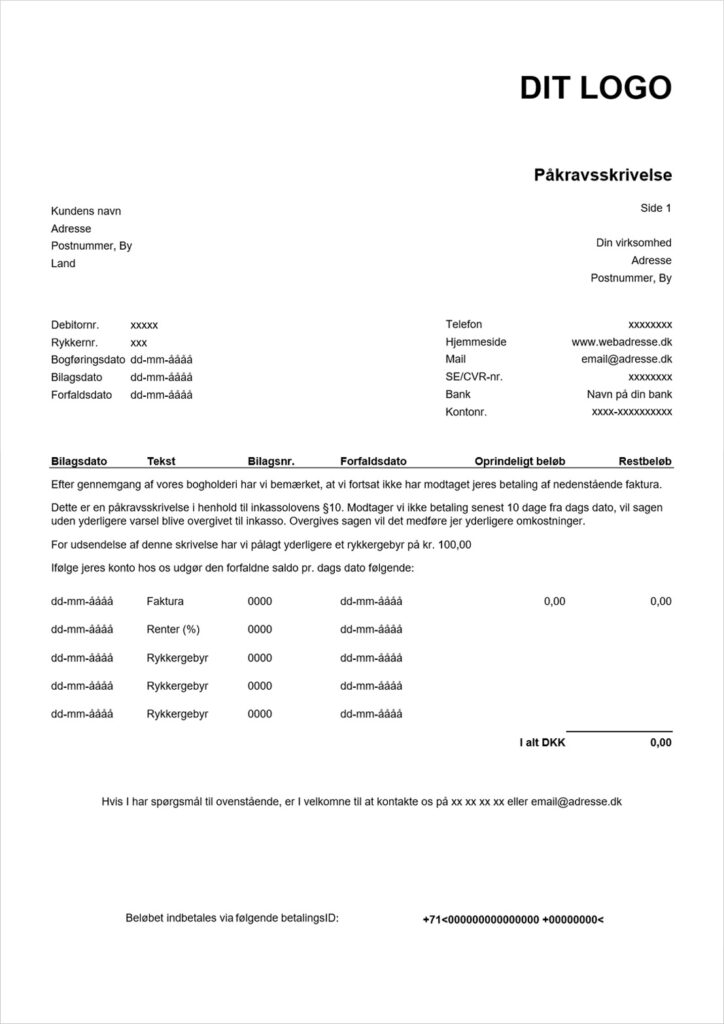

What does a letter of formal notice contain?

The letter of demand is regulated in section 10 of the Debt Collection Act, which states that before debt collection can be initiated, the debtor must be notified, which is done by means of a letter of demand.

There are basically no design requirements for a letter of demand, but it is important to

- "the demand letter clearly states all information necessary for the debtor's assessment of the claim"

- "that the debtor is given a period of at least 10 days from the sending of the demand letter" to pay.

In other words, it is important that you make the debtor clearly aware of the amount and, where appropriate, with reference to the original invoice and its invoice number.

Also, always remember to give the debtor at least 10 days to pay. If this is not the case, the demand letter is not legally valid.

We have prepared a letter of claim template that you can download for free here.

Letter of demand and judicial recovery

If you want to start a judicial debt collection procedure (either on your own or with the help of a debt collection agency), it is also important to be familiar with the letter of demand.

Before you can start judicial debt collection through the enforcement court, you must fill in a payment order, which is then sent to the enforcement court.

In the demand for payment, you must inform the enforcement court whether or not you have sent a letter of demand to the debtor. If this has not been done, judicial recovery cannot be initiated.

Read also:

Consequences of ignoring a letter of formal notice

If your debtor chooses not to comply with the 10-day payment deadline in the demand letter, you as a creditor now have the option of handing the case over to your lawyer or an authorized debt collection agency that can handle the actual collection.

You also have the option of initiating the collection yourself, with the associated interest charges, collection costs and the like.

If you subsequently decide to leave the case to an external partner (third-party debt collection), it is often a good idea to point out that a letter of demand has already been sent so that the debt collection company does not start from scratch.

Remember your reminder fee

It is a myth that you have to send reminder letters prior to a demand letter, you don't have to.

Reminder letters are an option for you as a creditor, but not a requirement. This means that you can shorten the process from non-payment to collection by not sending reminders in advance.

Remember that it is possible to combine a reminder letter with a demand letter, so that a reminder fee is charged.