Collection letter

A debt collection letter is a notice to a debtor that the debt collection process will be initiated in case of non-payment of one or more financial obligations, such as an invoice.

The debt collection letter is often also referred to as a debt collection notice, as it can be seen as a notice of debt collection. Others also call it a debt collection letter or a section 10 letter (with reference to the debt collection law).

However, there is no legally correct or incorrect use of the term and many people therefore use all terms. The Debt Collection Act uses the term 'warning letter' to refer to the debt collection letter - but in everyday speech most people use the term 'debt collection notice'.

What is the purpose of the debt collection letter?

The purpose of a debt collection letter is basically simple: to inform the debtor that if the payment for an outstanding balance is not paid within 10 days of sending the letter, a debt collection process will be initiated.

The purpose of the debt collection letter is therefore to give notice of debt collection. For this reason, the debt collection letter is also often referred to as a debt collection notice.

What are the requirements and rules for a debt collection letter?

There are a few, but very important requirements and rules for a debt collection letter.

Firstly, it is important that the debtor clearly understands the nature of the claim. In practice, it is often sufficient to simply state the invoice number and the amount or, if necessary, attach the invoice(s) in question.

Next, it is important to make the debtor aware that if payment is not made within a minimum of 10 days, the case will go to debt collection. If a payment deadline of at least 10 days is not included, the collection letter is not valid. In principle, you are allowed to give a longer deadline than 10 days.

It is allowed to add reminder fees to the collection letter and it is not a requirement that reminder letters are sent prior to a collection letter.

Who should send a debt collection letter?

We are often asked who should send the debt collection letter. There are many possibilities, because you as a creditor, your lawyer or your debt collection company can send it. The only requirement - whether it is self-collection or third-party debt collection - is that a debt collection letter must be sent before debt collection begins.

Often, an external partner (debt collection company or debt collection lawyer) would like to send the debt collection letter themselves to make sure that it is sent correctly. However, many people still choose to send the collection letter themselves before handing the case over to debt collection. However, it is important to always make sure to inform your external debt collection partner whether or not a debt collection letter has been sent, in order to shorten the debt collection process as much as possible.

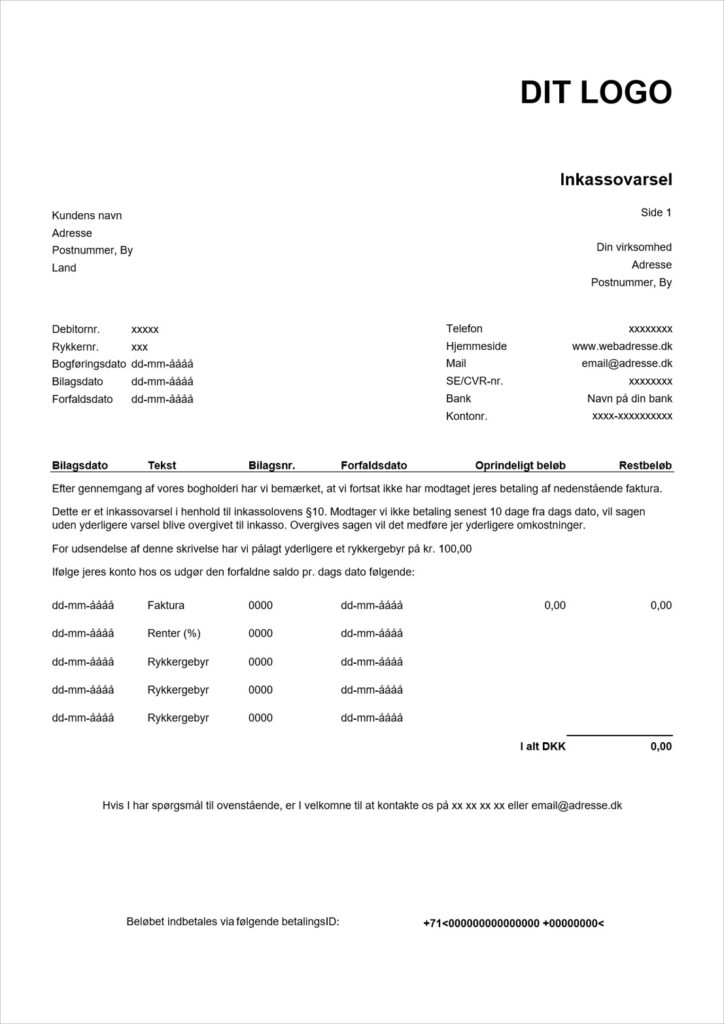

Collection letter example

If you need an example of a debt collection letter or a template, we here at Collectia have more than 150 years of experience with debt collection and of course also plenty of good examples of a debt collection letter.

Find all our debt collection templates right here: