Statute of limitations

Few companies realize it, but receivables, including invoice receivables, become time-barred. The statute of limitations for invoices is regulated in the Limitation Act, which sets the framework for when different types of claims (debts, invoices and the like) become time-barred - including the company's invoice claims.

In this article, we focus on the most common question we get from the statute of limitations; the limitation of invoices.

Therefore, we do not focus on the entire Limitation Act - and thus not the limitation of claims arising from, for example, damages, compensation for injury and the like - which the Limitation Act also addresses.

If you are a company and want to know about the topics most companies are interested in in the Act on the Limitation of Claims (Limitation Act) - you should read this.

What does the Limitation Act say about statute of limitations?

The subject of limitation is regulated in the Executive Order on the Limitation of Claims Act, also known colloquially as the Limitation Act.

The Danish Limitation Act defines what limitation is, when limitation occurs, how limitation is interrupted and, not least, how different debt claims can differ. The current Limitation Act is from 2015, but we always recommend that you check whether a new law has been passed in this area and use the current legal text as a starting point.

When does a debt expire?

Basically, two types of limitation are distinguished: 3 years and 10 years.

Most claims a business may have against a customer basically expire after 3 years, for example an invoice.

When a business issues an invoice to a customer, this claim is generally time-barred after 3 years. This means that a business cannot claim payment for an invoice older than 3 years or refer the case to, for example, a lawyer or a debt collection agency once the 3 years have passed.

The 10-year limitation period applies, for example, to promissory notes or other types of loans to a bank. In other words, if your business has a promissory note with a customer, this claim becomes time-barred after 10 years.

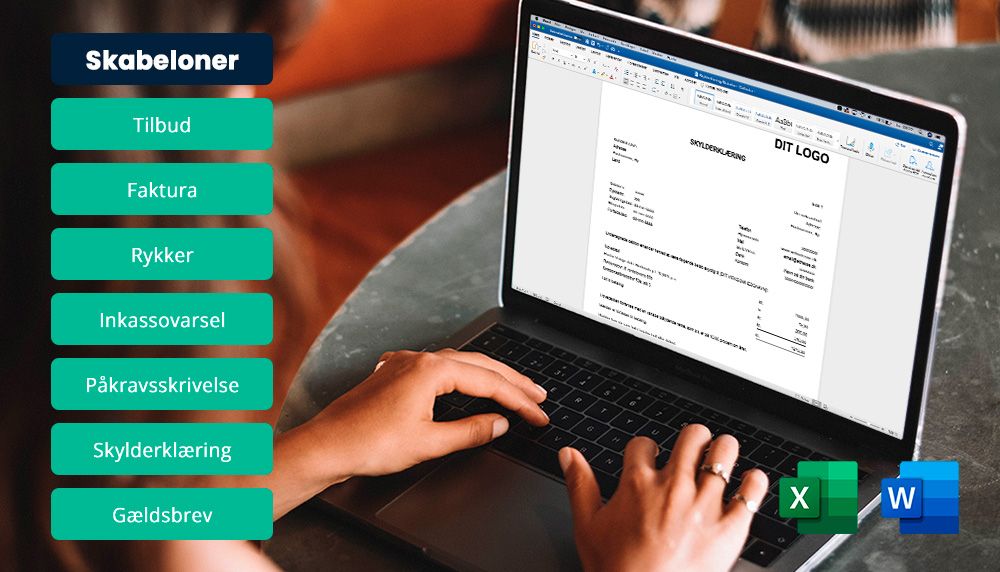

Read also: Download free promissory note template

When does an invoice expire according to the Limitation Act?

As a general rule, an invoice becomes obsolete after 3 years.

After 3 years, the debtor is no longer obligated to pay the invoice, and the creditor can no longer demand payment - even with the help of a lawyer, debt collection agency or bailiff.

However, it is possible to interrupt the statute of limitations, which both the creditor, the creditor's debt collection agency or the creditor's debt collection agency will often do - either through a promissory note or with the help of the bailiff.

In other words, interrupting the statute of limitations for an invoice claim requires an active action from the creditor - or the creditor's debt collection company or lawyer.

If the case is handled by a law firm or debt collection company, you will often be presented with the question of whether you as a creditor want to interrupt the limitation period or simply let the case lapse. This will always warrant an individual assessment.

Can the limitation period be extended?

Generally, debts are statute-barred after 3 or 10 years - then the claim must be considered lost.

But as a creditor, you can extend this. The legal term for extending a limitation period is called "interruption of limitation".

Interruption of the limitation period is regulated in Chapter 5 of the Limitation Act.

There are several ways to interrupt a limitation period, for example

- Get a written acknowledgement of the debt

- Create a promissory note - also, for example, on the basis of an already issued invoice

- Get a judgment for the amount owed

- A payment order from the enforcement court

In other words, you can interrupt the statute of limitations by getting a customer's written acknowledgment that he or she owes you the amount - preferably in the form of a signed promissory note. This promissory note has a statute of limitations of 10 years.

You can also get a lawyer or a debt collection agency to help you interrupt the limitation period for your debt with a creditor. However, we recommend that you do this in good time (at least 6 months)

When does the statute of limitations start to run?

Your debt is time-barred after 3 or 10 years - but the time when the limitation period starts is often a bit confusing.

According to the Limitation Act "the starting point of the limitation period", a claim (invoice claim or debt claim) is time-barred "from the time to which the claimant could have demanded satisfaction of the claim...".

In most cases, the 3-year statute of limitations for an invoice claim will thus count from the date of the invoice. If a company demands payment on August 1, 2024 - the claim will expire on August 1, 2027.

But if, for example, a company has delivered a product on August 1 - but did not send an invoice until December 1, the Limitation Act's section on "the time when the creditor could have demanded satisfaction of the claim..." would be debatable.

There are previous cases that the start date of the statute of limitations would be considered to be August 1 - and thus not the invoice date.

We always recommend that you as a business always send your invoices in the immediate vicinity of the delivery.

If you are considering interrupting a statute of limitations, we always recommend to be out in good time, have a dialogue with your debt collection company at least 6 months before the statute of limitations - that way there is plenty of time to start the necessary processes and any misunderstanding of the start date of the statute of limitations is minimized.

Is it a good idea to interrupt the limitation period?

Interrupting the statute of limitations will often be based on individual treatment, and it is fundamentally difficult to give general financial advice without knowing the individual circumstances. But in general, if a debt is extended from 3 to 10 years, there is a (theoretical) chance that the debtor's financial situation has changed and thus the possibility of starting an installment plan or making a full payment.