Reminder letter

What is a reminder letter?

A reminder letter is also commonly referred to as a reminder letter or simply a reminder. Whichever term your business uses, it refers to the same legal act: a letter reminding a debtor of one or more unpaid financial claims - typically, for most businesses, an unpaid invoice.

A reminder letter is voluntary and there is generally no requirement for you to send your customers a reminder letter prior to any debt collection action. However, there is a requirement to send a debt collection notice.

A reminder letter can take the form of a friendly reminder for non-payment, a bank statement or a letter where a reminder fee and a compensation fee may have been imposed.

What are the requirements and rules for a reminder letter?

There are basically no legal requirements or formalities for a reminder letter. You can design it however you want and you can basically send as many reminders as you want to your debtor.

If you want to impose a reminder fee on your reminder letters, there are a few requirements that you must comply with as a creditor if the reminder fees are to be legal.

The requirements for reminder fees are

- A maximum of 3 x DKK 100 reminder fees may be imposed per case.

- The debtor must have at least 10 days to pay the reminder fee (as well as the principal amount)

The reminder letter may be combined with a debt collection notice to save any time.

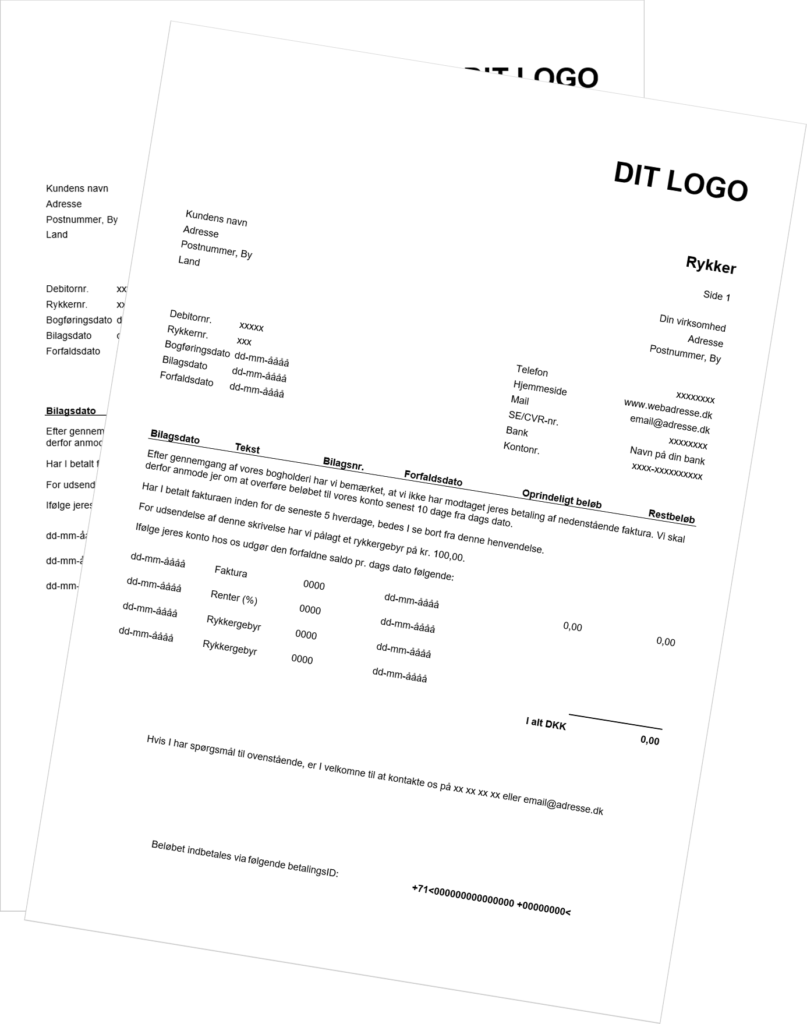

Free reminder letter template

Do you want to send out reminder letters to your customers yourself? Then you need to make sure that the reminder letter is designed correctly. That's why we recommend downloading our reminder letter template. This will ensure that your payment reminder is legally valid - even when the case is transferred to debt collection.

Fees you can impose on a reminder letter

As a creditor, you have the option of imposing a number of fees on your reminder letters, which basically help to cover part of the costs that, all other things being equal, you incur as a creditor when sending out reminder letters.

The most commonly used fee on reminder letters is a reminder fee. The requirements for the fees are relatively simple, but must be respected in order to be legally valid. The requirements can be found in the section above.

However, as a business, you also have the option of imposing a compensation fee of DKK 310 on your business customers. This fee may only be imposed on business customers, but may be imposed once, and together with or separately from your other reminder fees.

When should I send reminder letters?

Basically, it is up to you as a creditor to decide when you want to send a reminder for non-payment. There is no requirement to send a reminder letter prior to, for example, debt collection, as is the case with the debt collection letter/notice of collection.

Most companies have set processes and procedures for reminder letters; when they are sent, at what interval they are sent, how many are sent - and most importantly who they are sent to.

We recommend that you get into a regular routine of sending reminders, for example 5 or 10 days after the payment should have been made.

Remember, the quicker you can reminder your customers for payment, the more effective they are - and the quicker you can start a debt collection process if the reminder letter has no effect.

Please note that if you impose a reminder fee on your reminder letters, and you make use of all three reminder fees, it will take at least one month from the due date until any debt collection can begin. This can potentially be hard on your company's cash flow.

Your debt collection company can send your reminders

If you don't want to send out your reminder letters yourself, you can often ask your debt collection company or lawyer to do it for you. Such a service is often called a reminder service, which is a service that helps automate your reminders.

Most reminder services have an automatic switch to debt collection if the set reminders are not paid.

Talk to your debt collection agency or lawyer about the possibility.