Collection notice

Many people have heard of a debt collection notice, but what exactly is it? What text should you write in it and how do you handle it? In this post, we focus on the topic of debt collection notices.

What is a debt collection notice?

A debt collection notice, debt collection letter, demand letter, notice of debt collection, a §10 letter(debt collection law) - there are many names for it - is a notice that yourdebtor (debtor) must receive before the debt collection process starts and when its actions can and may begin.

Do not initiate debt collection against your customer if the customer has not been notified or if it has not been carried out correctly. This is what the debt collection notice is for.

The purpose of a debt collection notice is to notify your customer that if a claim is not paid within 10 days of the letter being sent, debt collection may commence. The collection notice is basically to give the customer a last chance to pay before additional costs are incurred and collection actions begin.

Drawing up a debt collection notice is easy to write and send to your debtor, but there are a few rather important formalities that you must observe - otherwise the notice is not valid.

The rules for notice of debt collection are regulated, among other things, in section 10 of the Executive Order of the Danish Debt Collection Act, also known as the Debt Collection Act.

The law does not specify who issues the debt collection notice, as in principle it could be you as a company, your lawyer or your debt collection company.

However, most debt collection agencies and debt collection lawyers prefer to send the collection notice themselves, so they know that all requirements have been met.

The debt collection notice is legally and formally (cf. the Danish Debt Collection Act) called a demand letter, but debt collection notice is the term most companies use for the letter - and in this article we choose to do the same.

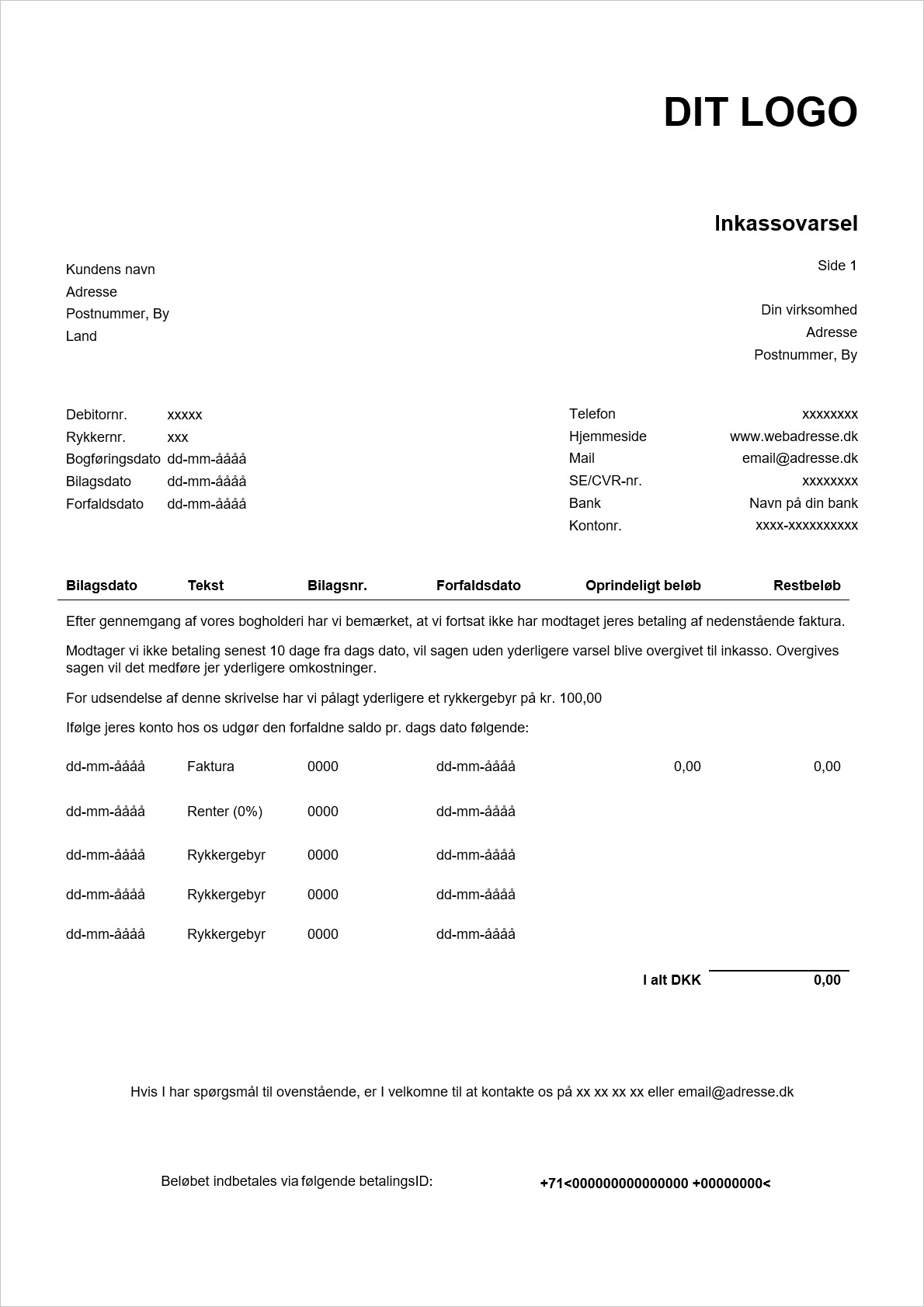

Download debt collection notice template for free

By filling in and submitting this form, you will be subscribed to our newsletter. Our newsletter brings you useful information on debt collection, debtor management, finances and advice on how to avoid bad payers. You can unsubscribe from the newsletter at any time.

What are the requirements and rules for a debt collection notice?

Regardless of whether the debt collection is done by yourself in the form of self-collection, via a debt collection lawyer, a debt collection agency or with the help of the enforcement court in the form of judicial debt collection - you must comply with the requirements and rules that apply to a notice before the debt collection notice is legal and valid. If you do not comply with the requirements, the notice is not valid.

If the creditor (or the creditor's collection agency or lawyer) has not sent a notice based on the requirements below, it is therefore also not possible (possibly later) to send a claim to the enforcement court.

Requirements for a debt collection notice look like this:

- Your debtor must be given at least 10 days to pay . The creditor is free to give a longer payment deadline on the collection notice than 10 days, as long as it is not shorter. We recommend 10 days as a starting point.

- According to section 10(2) of the Danish Debt Collection Act, the creditor must be able to identify the claim, typically by referring to an invoice number and specifying the amount and the services provided.

- Your information as a creditor, including your company name, CVR no., account and reg. number must appear.

- The debt collection notice must state that the case will be transferred to debt collection if the amount is not paid.

Collection notices and reminders

In a legal sense, there is a fundamental difference between debt collection notices and reminders.

As a business, you have the possibility to send reminder letters (with or without a reminder fee). Reminder letters allow you as a business to reminder for payment.

Whether you send reminder letters with or without reminder fees, these should be seen as an option for you as a creditor, not a requirement.

You can combine reminder letters and debt collection notices and you can impose a reminder fee on a debt collection notice. As long as the rules for both debt collection notices and reminder letters are respected.

It is not a requirement that you as a creditor have sent reminders before sending a debt collection notice - although it is often seen in practice that companies send 1, 2 or 3 reminders before sending a debt collection notice.

When can you send a debt collection notice?

In principle, you can send a debt collection notice when the payment deadline on an invoice has passed and you have established that the debtor has not paid the amount due on the invoice. However, we recommend that you wait 3-4 business days (weekdays) before initiating further action.

Another requirement that must be met is that the claim is not time-barred. Your invoice claim is normally time-barred after 3 years. However, if you have a judgment, a voluntary settlement or a promissory note against your debtor, the limitation period is up to 10 years.

We recommend that you set clear guidelines for when your company sends a debt collection notice. In practice, very few companies send a debt collection notice as soon as the payment deadline is missed - it often happens a few days or weeks later, possibly in combination with reminder letters and reminder fees.

Debt collection notice text and content

What does a good debt collection notice actually contain and what text is used?

There is no legally formalized text, design or setup for how a debt collection notice should be.

The most important thing is that the debt collection notice complies with the above requirements and rules regarding deadlines and clear identification of the claim.

However, we recommend that you use Collectia's free template, which is an example of how to set up a debt collection notice. Simply enter your details in the template and you're ready to send the letter.

Section 10 of the Debt Collection Act

Not many people are familiar with section 10 of the Debt Collection Act, but it's useful to know this section when sending out debt collection notices.

Section 10 of the Debt Collection Act stipulates the requirements for sending a debt collection notice and that no debt collection may be initiated - either by the company itself or by a debt collection agency - until a debt collection notice has been sent and the requirements for this have been met.

Section 10 of the Debt Collection Act states that you may only send a debt collection notice when the payment deadline on the invoice has been exceeded. In addition, you must clearly state all relevant and necessary information so that the debtor can assess the claim. It is also important that you give the debtor a payment deadline of at least 10 days.