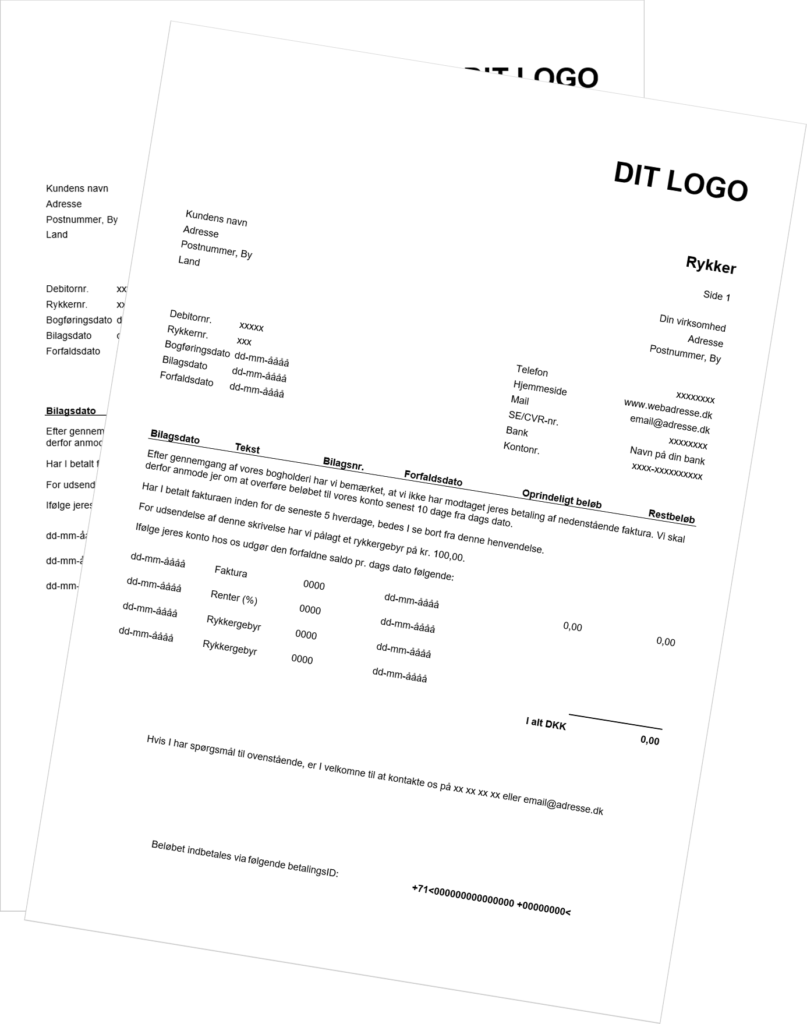

Reminder letter template

What is a reminder letter?

A reminder is a letter sent to a debtor to remind them of one or more outstanding payments.

Typically, reminders are sent as a result of one or more unpaid invoices. They can include a reminder fee or be sent without a fee.

Reminder letters are often referred to colloquially as reminders.

A reminder can be sent both by you, as a creditor, and by a debt collection company or lawyer.

Basically, there are very few and simple requirements for a reminder letter. However, there are requirements in relation to the payment deadline itself and the number of reminders sent when you impose reminder fees.

Why use a reminder template?

In Denmark, there are few formal requirements for the design of a reminder, and you have almost free rein to design it as you see fit.

Here at Collectia, we have more than 150 years of experience with debt collection, and therefore know what an effective reminder should look like. We have therefore designed a template that you can freely use and quickly get started with.

At Collectia, we have more than 150 years of experience in debt collection and therefore know how to design an effective reminder. That's why we've designed a template that you can use to get started quickly.

Download a free reminder template here

When you submit this form, we will send the template to your email. At the same time, you will be subscribed to our newsletter, which you can unsubscribe from at any time.

What should a reminder template contain?

You can shape and design your reminder template however you like. We recommend your reminder template contains:

- Debtor's name

- Debtor's address

- Amount owed by the debtor

- Date the reminder was sent

- Claim size, clearly illustrated

- Reference to original invoice number, if applicable.

- Original due date

- Payment term of 10 days

- Your bank details as a creditor

When can you send your reminder

You can send your reminder when a payment is found to be in default - typically 3-5 business days after the due date.

Keep in mind that payments can often take 1-2 business days to arrive. Therefore, you should give your debtor at least 3 days before sending a reminder.

Demand letters and reminders

Demand letters and reminders both aim to inform the debtor of an outstanding payment and offer an opportunity to settle the debt.

A reminder letter serves as a reminder of outstanding payments, while a demand letter is a notice of impending debt collection proceedings and is therefore often referred to as a debt collection notice. The demand letter offers a final opportunity for payment before the collection process begins.

It is allowed to include a reminder fee in a demand letter if the rules for this are followed.

It is not a requirement that a reminder letter must be sent before a demand letter.

Who sends reminders?

Anyone in your company, your bookkeeper, your accountant, your lawyer or your debt collection agency can send a reminder.

We recommend that you establish routines for who sends reminders to your customers. In many companies, it makes sense for the bookkeeping department to do this. In other companies, many choose to outsource the task to an external partner, such as a debt collection company.

From reminder to debt collection

Before debt collection can be initiated, the debtor must have received a debt collection notice or demand letter and have defaulted on their 10-day payment deadline. This applies to both extrajudicial and judicial debt collection where the enforcement court is involved.

A common misconception is that such a notice must be sent directly from the creditor before the case can be handed over to a debt collection agency or a debt collection lawyer. However, both debt collection agencies and debt collection lawyers can issue this type of notice as part of the process to assure the creditor that the claim is correct and timely.

What does a reminder letter contain?

An effective reminder letter contains information that one or more claims have not been paid and that the creditor now wants payment.

The purpose of the reminder letter is to inform the debtor of the non-payment and request repayment of the debt.

The reminder letter should clearly state what is being reimbursed and the specific amount, often with reference to an invoice number and the amount.