Reminder letter

A reminder letter may be necessary if a customer does not pay your invoice, but what is a reminder letter and what should you as a business know about it?

What you should know about reminders

Reminder letters are something most businesses use throughout a financial year if payments from customers are not made on time or are not received.

There are no formal requirements for what a reminder letter should look like, nor are there any requirements for how many you send to your debtor. As a company, you can, in principle, send reminders on a daily basis when an invoice is past its due date.

However, you should be aware that if your reminders contain reminder feethere are a number of requirements and rules that must be followed in relation to the number and frequency of mailings.

Many people often confuse reminder letter and reminder fee, but this is not entirely correct. A reminder letter is a letter to the debtor about one or more unpaid matters that a company has with a customer(debtor) and that the company(creditor) wants paid.

The Interest Act allows the creditor to add a reminder fee of DKK 100 per reminder sent, as long as the requirements are met.

Rules for reminder letters

The Danish Interest Act or the executive order on interest and other conditions for late payment allows the creditor to add a reminder fee of DKK 100 if the following applies:

- A reminder fee may only be charged 3 times on the same case/claim.

- A maximum of 100 kr. may be charged each time - legally, preferably less, never more.

- The creditor must give the debtor a minimum of 10 days to pay the reminder fee and principal.

- The reminder fee of 100 kr. is inclusive of VAT.

If the creditor does not comply with the above, the reminder fee is not legally valid and the debtor is entitled not to pay the reminder fee.

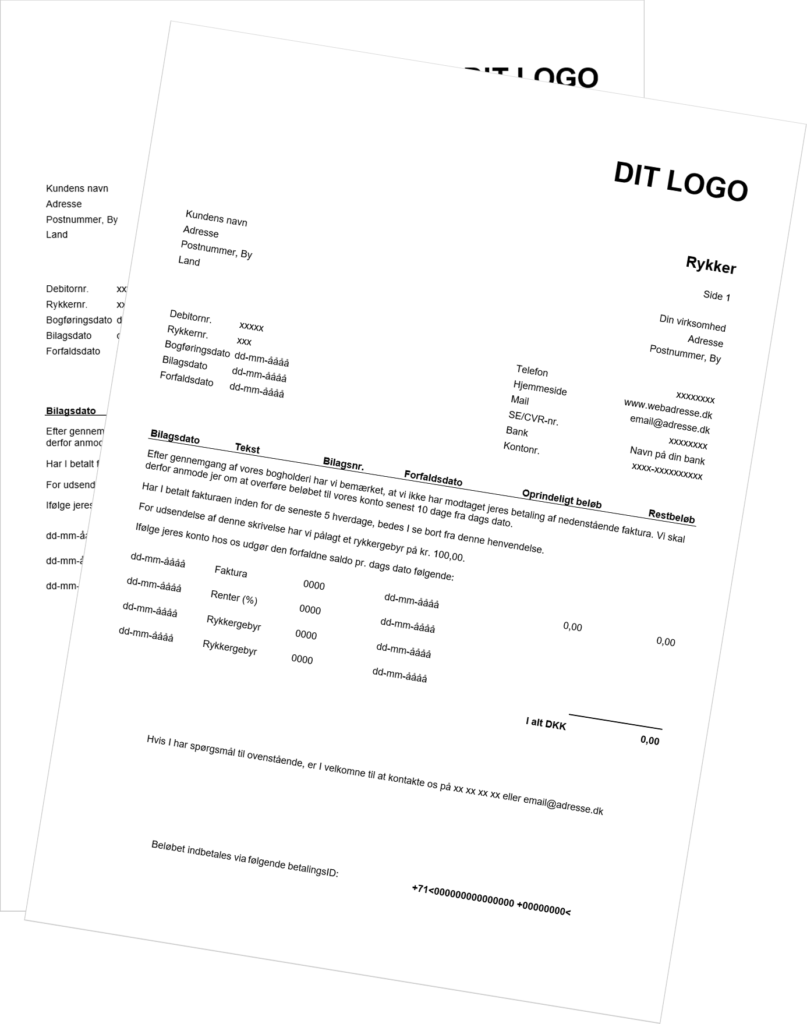

Example of a reminder letter

Formally, there are no legal requirements as to what a reminder letter should look like, neither those subject to a reminder fee nor those without a reminder fee.

Many companies choose to simply send a bank statement showing the balance due, others simply send a friendly reminder of non-payment. Both can be fine in situations where there is a simple oversight on the part of the customer.

Reminders can be sent by email, letter and any other way you have communicated with the debtor.

Free reminder template

We have prepared a reminder template for those who want to send out reminders themselves (we can also do it for you). By downloading our template, you can be sure that your reminders comply with all requirements and rules.

Reminder fee is not a requirement - but a good option

Many businesses are of the opinion that it is a requirement to apply a reminder fee on their reminder letters. However, this is not correct; reminder fees are an option for you as a creditor - not a requirement.

It is also not a requirement that you have imposed reminder fees if you later want to pass the case on to a debt collection agency or lawyer for further collection.