Self-collection - Do it yourself debt collection

Debt collection is about getting your money back - or at least making a determined effort to get it. In Denmark, debt collection can take place in many different ways: with a lawyer, with an authorized debt collection company or with the company itself - the latter is often called self-collection. Self-collection is basically about the company carrying out debt collection on its own, without external help.

In this article, we focus on the topic of self-collection and what you as a business can do yourself - and the many advantages and disadvantages of self-collection.

Self-collection - when to use it?

The term 'self-collection' means that the company collects debts on its own - without the help of, for example, a lawyer or a debt collection agency.

As a company, you can choose to handle debt collection entirely on your own - or you can choose to take care of some of the more preliminary tasks such as sending reminder letters, debt collection notices, demand letters and maybe even calling the customer yourself - there is no legislation on this.

As a company, you can basically do exactly the same things as a lawyer or an authorized debt collection company; send reminders, charge interest and fees, send collection notices, demand letters, call the customer(debtor) and, in extreme cases, send your customer to the enforcement court if necessary.

What are the advantages of self-collection?

As a business, there is basically nothing you can do that a debt collection agency or a lawyer cannot do when it comes to debt collection.

There can be many advantages to handling debt collection yourself. If your company often has very few collection cases annually and the collection cases are simple customer oversights, it can often be easier in practice to handle the sending of letters and calls yourself.

Many accountants often like to keep their debtors (your customers) close to them - and this is where self-collection can have its advantages. Often you know the customer well, which is why one or two reminders are sufficient to get the money back.

If you as a company are not successful with debt collection, nothing prevents you from passing the case on to an authorized debt collection agency or a debt collection lawyer.

What are the disadvantages of self-collection?

Of course, as a business, you must comply with all applicable rules and deadlines in this area - otherwise you may find that your self-collection is not legal.

In other words, with self-collection, there is a set of rules and deadlines that you as a business should familiarize yourself with. If the rules are not respected, your work may be wasted.

Self-collection, all other things being equal, requires more work from the company's own staff, who have to follow up on customers' requests - or lack thereof. The company's own staff must send out letters, apply the correct fees, etc.

For example, if an installment payment plan is successfully established, the company should monitor on a monthly basis whether installments are paid at the correct times, etc.

Debt collection using a debt collection agency or lawyer frees up a lot of resources. They often have automatic case creation (uploading unpaid invoices), reminders for installment payments, intuitive case portals for the company and the debtor, etc.

In addition, letters from a debt collection agency or a lawyer can often also have a stronger effect than when requests come from the company itself.

How does self-collection work?

Basically, there is no specific recipe for debt collection - and therefore no specific recipe for self-collection.

Whether your business undertakes debt collection itself, or it is carried out by a lawyer or debt collection company - there can be a multitude of options and outcomes in a debt collection case. The outcome often depends on the type of case and on your customer and their reaction. Therefore, it is difficult to predict the perfect course for debt collection and self-collection.

The most important thing about debt collection (and self-collection!) is that all processes are followed and that there is a clear framework of processes, rules and deadlines - something that your lawyer or debt collection agency often has a good grasp of.

If your company is going to start self-collection, there are basically the following debt collection activities that you can make use of:

- Send friendly reminders / payment reminders

- Sending reminder letters (with and without reminder fee)

- Send a debt collection notice

- Send out a demand letter

- Making calls to the customer

- Sending the customer to an enforcement court

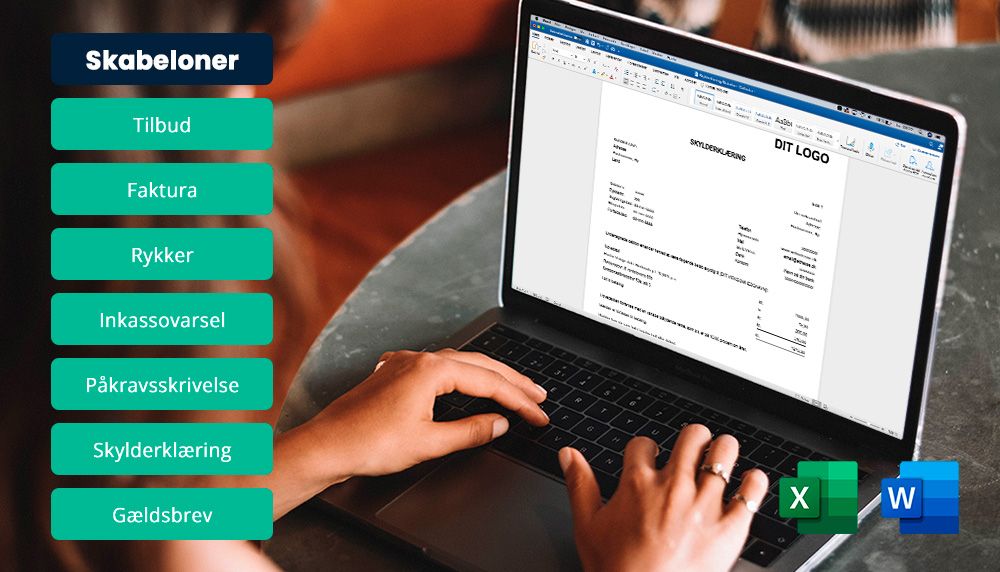

If you are going to start self-collection, here at Collectia we have collected a large number of guides, guides and templates that you can freely download and make use of. For example, we have a template for reminder letters, template for debt collection notice, template for demand letters and general tips for debt collection.

Questions on debt collection?

Do you have questions about debt collection? Remember that we here at Collectia are ready every weekday to help you get started with debt collection and recovery of your outstanding debt.

You can contact us on 77 30 14 80 or write to salg@collectia.dk if you need help.