Friendly reminder

The friendly reminder has been an effective tool for many years when a customer has forgotten to pay one or more invoices. In this article, we focus on the topic of friendly reminders and how you can make use of them in your bookkeeping.

What is a friendly reminder?

A friendly reminder is basically a reminder letter / reminder / reminder letter that is not subject to reminder fees. The reminder is called friendly because there is no cost to the debtor in connection with the reminder - its sole purpose is to inform the debtor of your outstanding balance.

How is a friendly reminder designed?

A friendly reminder is often designed like the company's other reminder letters / reminders, but without any fees; reminder fees, compensation fees or interest.

The friendly reminder can also be in the form of a bank statement, a balance statement, a monthly statement, an email, a call or other notification.

There are basically no formal requirements for how a reminder letter is written or designed. However, there are requirements for the reminder to visibly show what and how much the debtor owes and give the debtor a deadline for payment. We recommend that you make use of the requirements from reminder letters to streamline your mailings.

Note that there are no legal form or design requirements for a friendly reminder.

When to use a friendly reminder?

Basically, there are no restrictions on when you can use a reminder. The claim to the debtor just needs to be overdue - and the payment deadline has passed.

Most people use the friendly reminder as the first contact with the debtor, and thus often before the actual reminder letters where reminder fees, compensation fees and interest are charged.

There are no rules for whether the friendly reminder is sent 1, 2 or 3 times. We generally do not recommend sending more than one friendly reminder, as you will miss out on your opportunities to get your fees.

Why use friendly reminders?

There are many good reasons to use a friendly reminder - but the overriding reason, of course, is that you don't want to impose additional costs on your debtor because of a single missed payment.

The friendly reminder is often done in recognition that anyone can forget an invoice, and thus the friendly reminder is a gentle form of nudging the debtor and his non-payment.

Does a friendly reminder have an effect?

Anyone can forget to pay an invoice.

The friendly reminder has an effect on the many people who have simply forgotten one or more invoices by simple oversight.

However, the friendly reminder often has no effect on those who, for one reason or another, do not have the means to pay your invoice. In this case, the debtor will often prioritize the creditors who impose ongoing costs, as the consequence will have a greater financial impact - than the creditors who do not impose interest, reminder fees or compensation fees.

In our opinion, reminders have very little effect on the category of debtors who have no intention of paying your claim.

Template for a friendly reminder

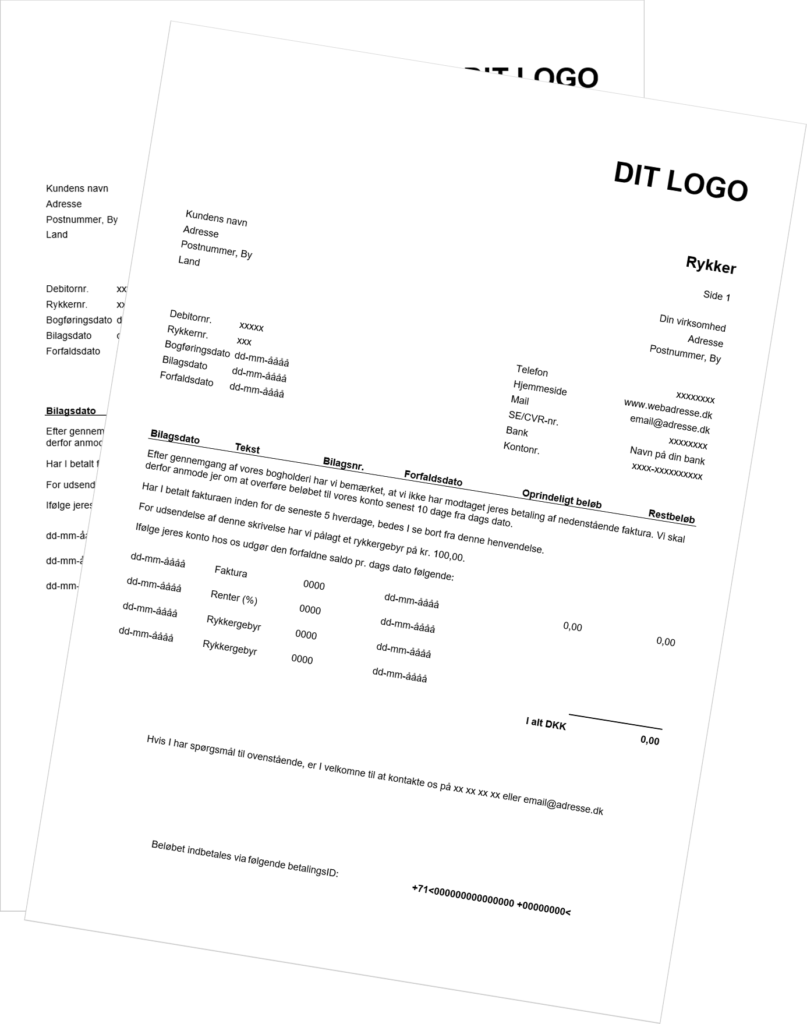

If you're looking for a friendly reminder template, we recommend starting with a reminder letter template.

By using a dunning letter template as a starting point, you can use the template both for your friendly reminder - but also for any subsequent dunning letters, should the need arise.

You can download our free dunning letter template - and use it for your friendly reminders - just remember to remove fees.

An alternative to a friendly reminder template would be to send a bank statement to the debtor. Most modern accounting and ERP systems can send a bank statement to a debtor.

Need help with debt collection?

At Collectia, we have more than 150 years of experience in debt collection and are one of the largest debt collection companies in the Nordics.

Every day, we help thousands of small and large Danish companies with their dunning process - including sending out friendly reminders.

Contact us today for a free, no-obligation chat about debt collection and effective debt recovery.